Prelude

Tokenization has set sail in the vast ocean of banking, with remarkable players like JPMorgan Chase, American Express, and Citigroup leading the way. These initiatives bear a resemblance to the early days of cloud computing in the financial world, where innovation took its confident first steps.

Imagine a world of Tokenization, where magical transformations bring tangible assets into the digital realm. Tokens, these captivating representations, find their safe haven within the secure embrace of blockchain technology. They become a fusion of a public key, providing both residence and protection and a private key, sacredly guarding the asset’s owner. Instead of physically relocating, transactions gracefully glide through digital contracts, shifting ownership in spectacular fashion.

In this dreamlike landscape, imagination runs wild, envisioning an array of financial wonders transformed into tokens: bonds, mutual funds, enticing securities, glittering commercial real estate, or even the iconic vigor of the almighty dollar itself. Tokenization truly excels in the complexities of business-to-business and cross-border payments, crafting elegant solutions for intricate transactions. It’s a remedy to the burdensome complexities, surpassing the simplicity already offered by peer-to-peer platforms like Zelle.

According to a report by MarketsandMarkets, the global tokenization market size is expected to grow from USD 1.3 billion in 2020 to USD 11.9 billion by 2025 at a Compound Annual Growth Rate (CAGR) of 42.5% during the forecast period. This growth is driven by the increasing adoption of blockchain technology and the need for secure and efficient transactions.

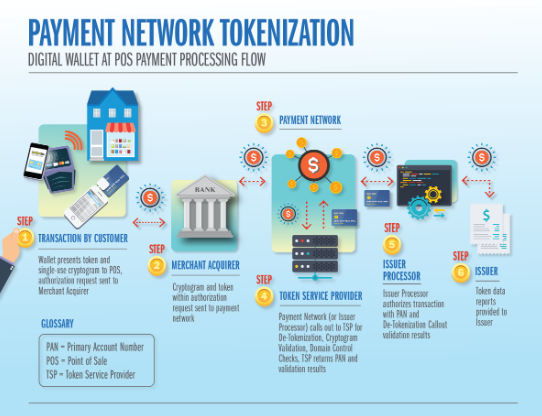

As we explore this realm, it’s crucial to understand the distinction between blockchain-based tokenization and credit card tokenization—a distinctive dance where credit card details twirl away, replaced by a captivating array of cryptographic symbols, creating a ballet of secure digital payments.

The financial landscape bathes in the rewards of Tokenization, from automated and impeccable recordkeeping to the dazzling speed of cross-border transactions, available day and night. As blockchain technology becomes more accessible, the flame of pursuit intensifies, igniting further discovery.

However, we must heed the creeping truth lurking in this world—the ever-looming “fear of missing out.” These words, softly spoken by Sudhir Pai, the Chief Technology and Innovation Officer at Capgemini, highlight the irresistible allure of Tokenization’s rise.

This grand tale introduces Tokenization as a golden path, inviting institutions—particularly large global banks—to delve into the promises and possibilities of trade finance, international payments, vibrant corporate treasury solutions, and captivating financial markets. Smaller banks, cautiously navigating treacherous waters, gauge the outcomes before taking the plunge.

Let’s explore the rise of Tokenization in banking, peer through the keyhole of possibilities, and uncover the secrets behind this revolutionary technology:

- Tokenization holds immense potential and advantages for financial services companies in terms of security, efficiency, and auditable transaction records.

- Tokenization allows for wider accessibility to previously inaccessible assets, enabling fractional ownership and diversifying investment opportunities.

- The speed and automation enabled by blockchain-based Tokenization revolutionize transactions, providing instant settlements and eliminating the risk of double-spending.

- The growth potential of Tokenization, coupled with its benefits in the realm of illiquid assets, offers endless possibilities for financial institutions to introduce new securities and tap into untapped markets.

- Collaboration and a network of banks embracing Tokenization are essential to maximize its benefits and scalability, prompting the need for a collective voice and ecosystem around Tokenization.

Read More: From Tokens to Liability: How RLNs are Transforming the USA Payment Landscape

The Evolving World of Tokenization: Revolutionizing Banking with Digital Assets

Let’s delve into the fascinating realm of Tokenization in the banking industry, where institutions are harnessing the power of blockchain technology to unlock new possibilities. Notable pioneers like JPMorgan Chase, Citi Treasury, and Bank of New York Mellon have embarked on a transformative journey, embracing the potential of tokenized assets.

Image 1: Tokenization In Payments

JPMorgan Chase has emerged as a frontrunner, embarking on its blockchain program way back in 2015. The culmination of their efforts led to the creation of Onyx Digital Assets, an innovative platform that revolutionizes transactions within the banking world. It even counts esteemed institutions like Goldman Sachs, BNP Paribas, Barclays, and BlackRock as partners, further amplifying its influence.

Through Tokenization, ownership records find a new home within digital assets themselves, streamlining recordkeeping and enabling exciting possibilities. Imagine the possibilities when the ownership of assets can be easily encoded, creating clarity and simplicity. One such innovation, Digital Financing, ushers in the future of seamless intra-day repo transactions. By instantly tokenizing treasuries or bonds, JPMorgan enables borrowers to receive instant cash as lenders retrieve their tokenized assets when the trade matures.

This transformative journey gains further momentum when we examine the speed and efficiency Blockchain technology brings. The ability to move tokenized assets at the speed of email revolutionizes the industry, paving the way for truly instant transactions.

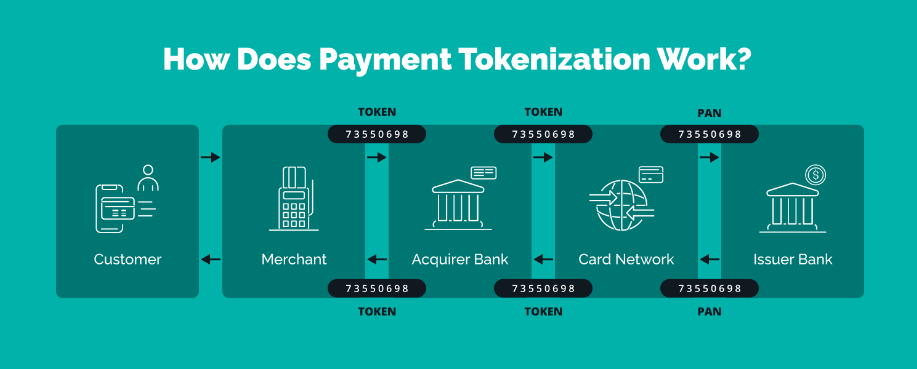

Image 2: The Mechanism of Payment Tokenization

Success stories are abundant: Digital Financing has already settled over $950 billion of repo transactions since its inception. The impact is tangible, with this innovative system making a significant impact daily. Tokens open up new frontiers – JPMorgan’s launch of the Tokenized Collateral Network (“TCN”) showcases their commitment to providing clients with more options, allowing assets like money market fund shares to be tokenized for use as collateral in derivatives transactions.

Citi Treasury and Trade Solutions have also entered the fray, creating their pioneering Citi Token Services to tap into the immense potential of Tokenization. Facilitating cross-border payments at any hour and facilitating trade finance with smart contracts, Citi aims to streamline processes, ensuring secure and efficient transactions for their clients. Collaborating with Web3 company Ava Labs, they drive innovation further by exploring the Tokenization of private equity funds.

Bank of New York Mellon recognizes the exciting prospect. Their forward-thinking approach focuses on leveraging Tokenization to simplify securitization, making it more accessible and digital. With a “fear of missing out” permeating the industry, it comes as no surprise that the possibilities have captured the attention of Banco Santander Argentina, Goldman Sachs, and HSBC.

Banco Santander Argentina embarked on a pilot program, backing loans with tokens tied to agricultural commodities, forging new avenues for financing through the transformative power of Tokenization. Goldman Sachs, not to be left behind, unveiled its live tokenization platform, GS DAP, shining a light on the incredible possibilities of digitizing assets. HSBC also made a significant move, announcing custody services for tokenized assets and even venturing into the Tokenization of the age-old precious metal – gold.

As the minds of visionaries continue to explore the boundaries of Tokenization, these dynamic developments create a ripple effect in the banking industry. The assurance of security, the speed of transactions, and the innovation derived from digitizing assets propel us closer to a new era of banking.

Every day bears witness to the expanding horizons as the world realizes that Tokenization is no mere concept but a tangible force driving the finance industry forward. The path toward a more digitized and efficient banking sector lies before us as we embrace the revolutionary possibilities of Tokenization. Secure your seat now, for the journey has just begun.

Tokenization in Banking: A Flight into the Future

So, here we are, delving into the avant-garde world of Tokenization. Experts say the possibilities are endless and oh-so-attractive for financial services companies. Matt Higginson from McKinsey puts it best, stating that Tokenization is like an ‘append-only database’. Picture a bulldozer leveling the path of history for that asset, creating an awe-inspiring record of who owned it, when it changed hands, all those delightful details. A financial services dream come true, my friend!”

Higginson, always ready with an example, dips into the realm of gold to make his point even shinier. He exclaims, “No need to trade an ounce or gram of gold! We can slice and dice that gleaming beauty into itsy-bitsy tokenized pieces, tiny fractions that can be owned by anyone, even those folks with tighter budgets! It’s like we’re holding the magic key, opening doors to a wider variety of people, all holding the glowing promise of investments.”

Now, imagine a world where trading happens at the snap of your fingers, Higginson continues with his wisdom. Thanks to Tokenization, the custodian and the eager buyer can have their seamless rendezvous anytime, any day, straight from their digital wallets. Goodbye to those “double spending woes!” Tokens keep everything in check, recording moments of ownership transition effortlessly on the remarkable blockchain.

Higginson winks as he summarizes this grand innovation: “No more deception! No slipping through loopholes or committing fraud. It’s like an army of computers joining hands, whispering assurances that what you own is the real deal, my friend.”

But it’s not just about efficiency, oh no. The growth potential is massive, more room for financial ventures to spread their wings, according to our wise friend, Pai. Imagine an oasis of illiquid assets like art or grand real estate, just waiting to be unleashed. Financial institutions can breathe life into an array of new securities, exposing the world to even greater wonders.

However, as amazing as this tokenization journey may sound, the banks are still dipping their toes in the shallow experimental pool. Proof-of-concept is the name of the game, my friend, as they figure out the fuzzy details – the right blockchain type to use, how to protect those precious assets, the regulatory dance they must master.

“It’s technically possible, but operationally a beast,” Pai muses cunningly, with a cheeky grin. And let’s not forget the allure of generative artificial intelligence—banks are bewitched by its siren song, captivating their attention away from delving too deep into the realms of Tokenization. Oh, the complexity, the murky waters of regulation! These prudent financiers are keen not to stir the regulatory pot, ensuring silky smooth sailing through uncharted territories.

“Our regulators need their beauty sleep,” Lobban chuckles, his light-hearted remark revealing the careful tightrope the industry must gingerly tread. It’s a delicate dance, my friend, ensuring that regulators and practitioners confidently waltz together in this captivating ballroom of innovation and compliance.

And as we look at the grand vision, the scale, and the dream of Tokenization reaching its full potential, Olsen reminds us that it’s not just about one bank waltzing solo to the Tokenization beat. No, no! It’s a ballet of agreement, my friend—multiple banks joining together to create a harmonious tokenization orchestra. Syndicated loans, for example, can only truly flourish when a network of banks sways in unison, reaping those juicy benefits together.

Still, among the collective dance, Nadine Chakar, the global head of DTCC Digital Assets, reminds us of the importance of collaboration. Instead of fierce competition, she encourages financial services players to join hands in unison, like a mighty army marching together towards a steel wall of progress. She rallies the troops, reminding them that true strength lies in their collective voices, a symphony that will carry the ball of innovation far into the future. They are in the early innings, my friend, laying the foundations and gaining wisdom as they pave their way to greatness, ensuring their shared infrastructure shines brighter with each passing day.

To sum it up, Tokenization in banking is gradually taking flight, with JPMorgan Chase and Citigroup leading the charge. These pioneering institutions are laying the groundwork for what some experts liken to the early days of cloud computing in financial services. Just as the cloud revolutionized the way data was processed and workflows were managed, Tokenization promises to streamline and scale the handling of financial assets.

A token, in essence, is a digital representation of a real-world asset secured by a public key (its location on the blockchain) and a private key (unique to its owner). Transactions involve changing ownership rather than physical location, facilitated by digital contracts instead of traditional ones. The potential for Tokenization is vast, encompassing bonds, mutual funds, commercial real estate, and even currency.

This technology is particularly useful in complex transactions, such as business-to-business or cross-border payments, where the speed and security of blockchain-based Tokenization can be a game-changer. Peer-to-peer payments, already instantaneous through services like Zelle, are less likely to benefit from Tokenization.

It’s important to note that Tokenization in banking is not to be confused with credit card tokenization, which replaces a card’s primary account number with a randomly generated set of numbers to secure digital payments.

So, let us embark on this remarkable adventure together, my friend. The journey may have just begun, but the energy, innovation, and camaraderie in this ever-evolving world of Tokenization are truly intoxicating. The stage is set, the actors primed, the future brimming with prospects as we continue to pen this thrilling tale of finance and technology. Are you ready to waltz, dip, and swirl to the rhythm of Tokenization’s promising beat? Bravo! Let the dance begin!

Incorporating MSys Technologies into this narrative adds another layer of expertise and innovation to the unfolding story of Tokenization in banking. MSys Technologies, known for powering cutting-edge solutions and technological prowess, brings a unique perspective to the table, further enriching the landscape of digital transformation in the financial sector. Let’s join hands with MSys Technologies as we embark on this transformative journey into the world of Tokenization.

FAQs

1. What is Tokenization in banking, and how does it revolutionize the industry?

- Tokenization in banking involves digitizing assets on a blockchain and creating secure digital representations of real-world assets like bonds, mutual funds, and commercial real estate. This innovation streamlines transactions, enhances security, and opens up new investment opportunities.

2. How does Tokenization benefit financial institutions in terms of security and efficiency?

- Tokenization offers enhanced security by replacing physical assets with digital tokens secured by blockchain technology. It also improves efficiency through instant settlements, automated recordkeeping, and streamlined transactions.

3. Which key players are driving the adoption of Tokenization in the banking sector?

- Leading financial institutions like JPMorgan Chase, Citigroup, American Express, and others are at the forefront of embracing Tokenization to transform the handling of financial assets and transactions.

4. What distinguishes blockchain-based Tokenization from credit card Tokenization in the banking industry?

- Blockchain-based Tokenization involves creating digital representations of assets on a blockchain for secure transactions. In contrast, credit card tokenization replaces sensitive card details with encrypted tokens to enhance payment security.

5. How does Tokenization facilitate cross-border payments and business-to-business transactions in banking?

- Tokenization simplifies complex transactions like cross-border payments by leveraging blockchain technology for secure and efficient transfers. It enables instant settlements and eliminates risks like double-spending.

6.What are the growth projections for the global tokenization market in banking, according to industry reports?

- Industry reports forecast significant growth in the global tokenization market size, with estimates indicating a rise from USD 1.3 billion in 2020 to USD 11.9 billion by 2025 at a Compound Annual Growth Rate (CAGR) of 42.5%.

7. Why is collaboration among multiple banks crucial for the success of tokenization initiatives in banking?

- Collaboration among banks is essential for creating a harmonious ecosystem for Tokenization to thrive. Syndicated loans and other financial instruments benefit from collective participation, enhancing liquidity and scalability.

8. What role do innovative technologies like blockchain play in driving the adoption of Tokenization in the banking sector?

- Blockchain technology underpins Tokenization by providing a secure and transparent platform for digitizing assets. Its decentralized nature ensures trust and immutability in transactions, fostering confidence among stakeholders.

9. How does Tokenization enable wider accessibility to previously illiquid assets for investors in the financial market?

- Tokenization allows fractional ownership of assets that were traditionally illiquid, such as real estate or art. This democratizes investment opportunities, diversifying portfolios and expanding access to a broader range of assets.

10. What are some practical examples of successful tokenization initiatives by prominent banks showcasing the transformative power of this technology?

- Banks like JPMorgan Chase, Citigroup, Bank of New York Mellon, and others have launched innovative tokenization projects facilitating instant settlements, cross-border payments, and collateralized transactions using digital assets. These initiatives demonstrate the tangible benefits and potential of Tokenization in modernizing banking operations.