The Digital Finance 2.0: Transforming Cashless and Contactless Payments like a Phoenix

Introduction

The digital transformation in financial services is revolutionizing the way we handle payments. The advent of digital finance has led to a surge in cashless and contactless payments, with electronic and mobile payments taking the lead. This new era of payment innovation has brought about a shift in corporate payment trends, changing the traditional card swiping method to a touchless, no-touch, sleek, and hands-free experience.

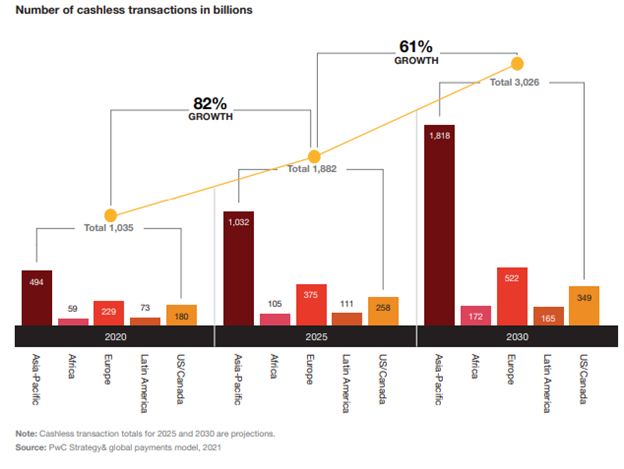

According to a report, as many as 1.3 billion people might switch to cashless transactions by the end of 2023, with mobile payments being a preferred choice.

This blog, ‘The Digital Finance 2.0: Transforming Cashless and Contactless Payments like a Phoenix,’ will delve into how digital finance 2.0 is transfrming the cashless and contactless payment realms, making individuals and businesses transact hassle-free and seamlessly.

What Is Digital Finance

Digital finance refers to the use of technology and digital platforms for financial services and transactions. Cashless and contactless payments are the types of digital finance that enable consumers to make transactions without using physical cash or physical contact with payment terminals.

Examples of cashless and contactless payments include mobile payments (e.g., Apple Pay, Google Pay), card payments (e.g., credit and debit cards), and electronic payments (e.g., PayPal). These payment methods are becoming increasingly popular due to their convenience, speed, and security.

How The Digital Surge Is Reshaping Finance

The digital finance revolution is modernizing and upgrading the traditional financial services industry. The rise of digital finance 2.0 is transforming payment trends and shaping the future of corporate payment practices. The payment industry is undergoing a digital transformation, with payment innovation and the cashless payments bank business model leading the way. The surge in digital finance is reshaping the financial services sector, with an increased focus on electronic payments, mobile payments, and card payments.

The trend towards cashless societies and the decreasing reliance on card swiping drive the growth of touchless and no-touch hands-free payment methods. These modern payment options are helping to create a more seamless and efficient payment experience for consumers and are helping to usher in a new era of digital finance.

Modernizing Money: The Emergence, Diversification & Phylogenesis of Digital Finance 2.0 into Cashless & Contactless Payments

The world of finance is undergoing a massive transformation, with the emergence of digital finance 2.0 leading the charge. The modern payment landscape is being shaped by the diversification and phylogenesis of digital finance into the cashless and contactless payments arena, shaping the future of finance as we know it.

With the help of advanced technologies such as mobile payments, card payments, and electronic payments, consumers can now make transactions with ease, speed, and security. The diversification of digital finance has given rise to new and more efficient payment methods, and the industry has seen the growth of payment solutions that are tailored to the specific needs of different consumers and businesses.

The shift towards digital finance and cashless and contactless payments has created a more seamless and efficient payment experience for consumers and has also brought about new opportunities for businesses in the payment industry. This new era of digital finance is providing financial services that are faster, more secure, and more accessible and is helping to create a more inclusive and equitable economic ecosystem for all.

Let’s scrutinize several components of digital finance.

1.Digital Banking

Digital banking refers to using digital technology to provide banking services, such as online and mobile banking. With the proliferation of digital banking, the modern payment landscape is becoming increasingly cashless and contactless as consumers and businesses adopt more efficient and convenient payment methods. The use of digital technology in the banking sector has made it possible for banks to provide digital banking services such as online and mobile banking. In 2022, we witnessed incumbent banks taking the lead by launching their own digital banking subsidiaries or partnering with industry players, while challenger banks broadened their offerings from basic accounts and cards to credit, investment, insurance, and crypto services. Some prominent players are ANZ, ANT GROUP, Brex, Nubank, Standard Chartered, GxS, Capital bank, Revolut, and Bunq.

In 2023, banks and credit unions continue to partner with FinTechs to revolutionize their digital services landscape, casting a positive impact on the cashless and contactless payments realm with the rise of mobile payments and electronic payment platforms, such as mobile wallets, QR code scanning, and touchless card payments. These payment options offer consumers and businesses faster, more secure, and more accessible transactions, making it easier to pay for goods and services without the need for physical cash.

2.Digital Infrastructure

Digital infrastructure refers to the technical systems and hardware that support digital finance. In the context of digital finance, it encompasses the technology and systems that allow financial transactions to be conducted electronically.

The digital infrastructure improvement has led to an increase in cashless and contactless payments. Financial institutions have formed partnerships with core banking infrastructure providers such as SBM bank, Carbon, MAMBU, Tuum, Stripe, OPEN, LHV, Trust, Tonik, and Thought Machine to accelerate their shift to digital finance. These partnerships aim to streamline time-to-market for product launches and enhance customer experiences by utilizing modern banking technology. By improving the digital infrastructure, financial institutions offer their customers more efficient and convenient payment options.

3.Digital Payments

Digital payments refer to financial transactions that are conducted electronically using digital technology. Digital payments are a vital component that allows individuals and businesses to transact without needing cash.

The advancement of digital payments has led to an increase in cashless and contactless transactions. The evolution of digital payments has included launching new payment types, such as person-to-person (A2A) payments, recurring payments, and cross-border payments. Businesses have also benefited from digital payment innovations, with the launch of efficient payment products for accepting and disbursing payments to employees and suppliers. By promoting digital payments, financial institutions are able to offer their customers more convenient and secure payment options. Some prominent examples of innovative payment products include Bizum, Cash App, N26, ABN-AMRO, Adyen, Starling Bank Solutions, Bexs, and YOUNITED.

4.Digital Lending

Digital payments and digital lending are related concepts in digital finance. Digital payments refer to financial transactions conducted electronically, while digital lending refers to providing credit and loans through digital channels.

Digital lending has helped boost cashless and contactless payments by expanding the product offerings of digital banks. Digital banks have introduced various credit line options, such as loans, mortgages, buy now pay later (BNPL), and credit cards, to improve their unit economics and ensure profitability during economic uncertainty. Launching these credit products has made it easier for individuals and businesses to access credit and transact without the need for cash. These popular products include Tonik, Fiinu, TransUnion, Revolut, Atom bank, and JUNI. By offering these digital lending options, financial institutions provide their customers with more convenient and secure payment solutions.

Cashless and Contactless Payments Landscape

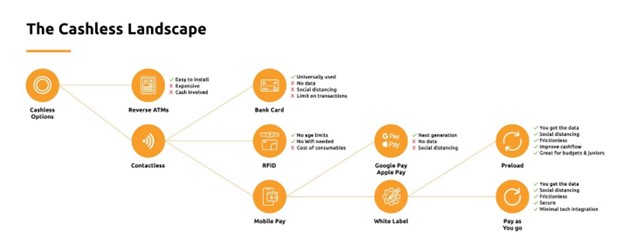

Cashless and contactless payments are payment methods that allow transactions to be made without physical cash or cards. The rapid evolution of digital finance 2.0 has driven the proliferation of cashless and contactless payments.

Here is a table depicting different types of cashless and contactless payments and some examples of companies providing such services:

| Type of Payment | Description | Companies Enabling Cashless & Contactless Payments |

| Mobile Wallet | A digital wallet stored on a mobile device, allowing users to make payments via their smartphones | Apple Pay, Google Wallet, Samsung Pay |

| Contactless Card | A physical card with a chip that uses NFC technology to make payments | Mastercard, Visa, American Express |

| Online Payments | Payments made through websites or mobile apps | PayPal, Amazon Pay, Stripe |

| QR Code Payments | Payments made through scanning QR codes | Alipay, WeChat Pay, Paytm |

Cashless and contactless payments are similar in that they both allow for transactions to be made without the use of physical cash. However, they have differences that make them distinct payment methods.

Contactless payments, including online payments, are Open Loop Payment Systems that involve a third party, such as a bank or payment processor. On the other hand, cashless payment systems are Closed Loop Payment Systems that operate without any third-party intervention, with end users directly joining the scheme. Closed-loop payment systems give vendors ownership over the entire vendor/customer process, while open-loop techniques involve a third party in the payment process.

Digital Finance 2.0 Gird: Challenges & Opportunities of Cashless and Contactless Payment Systems

Constantly evolving within the digital finance 2.0 grid, cashless and contactless payment systems offer challenges and opportunities for businesses as they navigate the rapidly changing payment landscape. The table below categorizes the different dimensions of challenges and opportunities of cashless and contactless payments. MSys Technologies offers full stack-FinTech services to help businesses convert these opportunities into tangible business outcomes and overcome the challenges along the way.

| Dimensions | Challenges | Opportunities | MSys Technologies Full stack-FinTech Services |

| Security | Risk of fraud and data breaches | Improved security and efficiency through advanced technologies such as encryption and multi-factor authentication | Full stack-FinTech services to implement advanced security measures and technologies to minimize risks of fraud and data breaches.

|

| Accessibility | Lack of widespread infrastructure and technology | Increased accessibility for consumers, particularly for those without access to traditional banking services | Full stack-FinTech services to expand and improve infrastructure and technology, increasing accessibility for consumers, particularly for those without access to traditional banking services, and providing a more inclusive financial services experience:

|

| Interoperability | Difficulty in integrating with existing systems and processes | Improved interoperability through standardized technologies and APIs | Full stack-FinTech services to streamline and standardize integration with existing systems and processes, reducing complexity and friction, and providing a more seamless financial services experience:

|

| Customer Experience | The complexity of new payment methods | Enhanced customer experience through streamlined and simplified payment processes | Full stack-FinTech services to simplify and improve the customer payment experience by streamlining payment processes, providing a more accessible and convenient customer experience, and reducing complexity in financial transactions:

|

| Prolific Digitization & Complex Payment Infrastructure Matrix | Significant investment is required in online payment solutions. Reshaping the entire payments infrastructure. |

1. Shift towards e-commerce 2. Move towards real-time payments 3. Emergence of new business models in payments 4. Advent of Mobile-centric digital economies 4. Evolution of front- and back-end parts of the payment system 5. Revolution in payment mix and ecosystem |

Full-stack FinTech development services to support organizations in determining where to play and how to win through technology solutions to seamlessly navigate through the complex payment matrix. Strengthening the competency of clients by providing end-to-end front-end and back-end payment system development by providing services to enable instant payments, digital wallets, mobile wallets, buy now, pay later, disrupting payment services paradigm with super app services, and much more. |

| Regulatory Trends | With stringent regulations come limitations, and too much contemplation can hinder innovation; compliance costs on FinTechs and digital banks. | Regulatory oversight provides stability and inspires trust among customers; it levels the playing field for all FinTechs and digital banks. | MSys Technologies is a full-stack FinTech service serving a one-stop-shop solution for various aspects of financial services, such as payments, lending, wealth management, and more. This can help these institutions reduce compliance costs and streamline operations while offering consumers a more seamless and convenient experience. These services add significant value by assisting FinTechs and digital banks to navigate regulatory challenges and capitalize on new opportunities. Furthermore, full-stack FinTech services can leverage their technology and data analytics capabilities to enhance regulatory compliance, for example, by automating compliance processes, monitoring transactions for suspicious activities, and providing greater transparency and reporting. This can help these institutions to stay ahead of regulatory changes and provide excellent protection to consumers. |

| Diversity, Inclusion, and Reliability | Promoting diversity and inclusivity in the financial services sector can help reach underbanked and unbanked populations, leading to greater financial inclusion and improved access to financial services. This can drive the growth of cashless and contactless payment systems in regions such as Africa, Latin America, and Asia. | Ensuring the privacy and security of consumer data is a key concern, as well as building trust in new payment providers and methods. | Full-stack FinTech services by MSys Technologies play a crucial role by addressing these challenges to overcome, and to ensure the reliability and stability of cashless and contactless payment systems promoting diversity, inclusion, and reliability. Thus, digital banks and FinTechs can capitalize on the opportunities to drive greater financial inclusion and improved access to financial services. |

| Currency Multipolarity | According to Pwc, 60% of central banks are exploring digital currencies, and 14% are conducting pilot tests. However, central banks also have concerns about the potential for decentralized finance and private cryptocurrencies to undermine the conduct of monetary policy. | Digital currencies, including central bank digital currencies and private cryptocurrencies, offer new possibilities for cashless and contactless payment systems. The rise of digital wallets, such as mobile payments, QR codes, and open banking, is driving the adoption and usage of cashless and contactless payment systems, driven by convenience and ease of use. Digital wallets are also expanding into B2B and digitized supply chain markets, providing new frontiers for growth. Shift to digital wallets backed by open banking will pivot the regulators to stimulate the digital finance realm for better infrastructures, in particular, the domestic cashless and contactless payment methodologies. |

MSys’ full-stack FinTech engineers their technology and data analytics capabilities to provide an array of financial services, such as fiat-cryptocurrency conversion and storage services, as well as enhance the security and reliability of their services. |

| Cross-border Transactions | The lack of global standardization for cross-border payments creates obstacles to seamless connectivity and interoperability between different payment systems, including cashless and contactless ones. Security and privacy concerns and regulatory challenges remain central themes. | The drive for instant, low-cost cross-border payments is leading to the reinvention of these payment systems, making them more efficient and accessible; parallelly, such an ecosystem involves the proliferation of cashless and contactless payment systems. Regional solutions, particularly in Asia, and global non-bank solutions based on cryptocurrency and digital wallets are emerging as alternatives to traditional cross-border payments. These include cashless and contactless payment systems as popular choices. |

|

Wrap Up

Cashless payments, online systems, and digitally enabled transactions have become the norm for many businesses, leading us towards a renewed future powered by a digital finance system – Digital Finance 2.0 – which promises to use emerging technologies like blockchain, AI, voice recognition, machine learning, and biometrics to facilitate secure online and real-time transactions.

This uptake in digital transformation in financial services has also been expedited by the Covid-19 pandemic, where social distancing rules have affected traditional methods of transactional behavior such as using physical cash.

Digital Finance 2.0 is here to revolutionize and empower cashless societies with cutting-edge technologies. With that, we see new business paradigms emerging in finance attributed to the acceleration in the technological development of the last decade.

Modern technology is shaping, evolving, and transforming our cashless and contactless payment experiences like a phoenix rising from the ashes!

As open banking and instant alternative payments gain adoption among consumers and businesses, the digital finance landscape is expanding, presenting opportunities for the growth of cashless and contactless payments in particular, but also increasing the threat of organized fraud-as-a-service. To navigate these challenges smoothly and capitalize on opportunities, it’s crucial to adopt full-stack FinTech services like those offered by MSys Technologies. These provide a comprehensive solution to address the ever-evolving demands of the digital finance world. Build a resilient FinTech ecosystem with the help of MSys’ expert full-stack FinTech engineers to navigate even through the most sophisticated security, data privacy, and financial fraud risks.

So, don’t be a square peg in a round hole;join the FinTech revolution with MSys Technologies. Upgrade Your Payments Game, One Byte at a Time!