What is Embedded Finance & How Its Rise is Making Banks Omnipresent

Audio : Listen to This Blog.

Introduction

“Moonlit Epiphanies: When the Dawn of Digitalization Unfurls ‘Finance-Enmeshed-in-Daily-Life’: Illuminate a High Sky as Sapphire Finches Soar Above the Uncharted Streaming Currents”

The digital age has revolutionized the way consumers interact with financial institutions, prompting a shift towards embedded finance. The world of finance is in the midst of an unparalleled transformation. The relatively new concept known as ‘Embedded Finance’ is standing at the forefront of this evolution. Harnessing the power of technology and digitalization, embedded finance is seamlessly weaving banking and finance into the lives of consumers, right where they nearly spend most of their online time – non-financial platforms like online retail, marketplaces, ride-sharing services, and many more. This revolutionary concept is acting as a pivot, completely changing our approach toward financial transactions and making banking more accessible. This emerging trend, which integrates financial products and solutions into the customer journeys of non-financial organizations, is reshaping the banking landscape. In this article, we will explore – “Embedded Finance & How Its Rise is Making Banks Omnipresent” and why banks should leverage this trend to stay relevant and competitive.

Embedded finance is being adopted and appreciated across different verticals such as retail stores, hospitality e.g., in fancy restaurants, the ever-growing real estate industry, transportation, and even in various emerging media platforms. Significantly, as the acceptance and popularity of embedded finance expands, a wholesome perspective has dawned on the fintech realm, a bigger picture that reveals the profound transformation that technology can bring forth for businesses and customers alike. Fast-paced economic shifts are directly translating to dynamic challenges confronted by financial institutions. It is demanding innovation, making the game even more thrilling for adventurous vanguards taking a leap to ride this giant wave of digital banking transformation.

At MSys Technologies, acclaimed as the #1 embedded finance service provider in the USA, we cater noticeably to this transformative push, empowering banks to be not only more versatile and pliable but versatile in ways that echo the marketplaces where consumers cavort. This potent glyde of finance wielded into everyday platforms is the essence of embedding finance and our contemporaneity. We facilitate more estimable orientations for FinTechs and banks to leverage this burgeoning trend so that our clients remain invincible with their end-to-end FinTech engineering competence.

Now, let’s delve into the tug of opportunities laid wide open by this booming facet of digital finance, which is both exciting and challenging.

Understanding Embedded Finance & Its Benefits

“From Dappled Sunbeams to Melodic Wonders: Embedded Finance Paints a Dazzling Portrait Against the Backdrop of the Babbling Brook”

Embedded finance refers to the seamless integration of financial services within the offerings of non-financial service providers. By eliminating friction and enhancing the customer experience, embedded finance has gained traction among consumers and businesses alike. Traditional banking models are being challenged by the rise of neobanks, digital banks, and fintech startups, all of which are capturing a significant share of the embedded finance market.

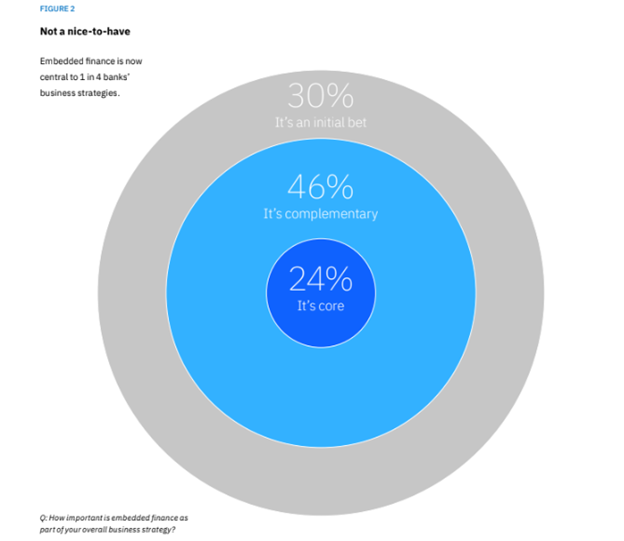

Embedded finance is a critical component of modern banking strategies, with 70% of banking executives stating that embedded finance is either core or complementary to their business strategy. Financial institutions are increasingly investing in the platform economy, with 20% of organizations already offering embedded finance solutions. However, bank executives’ priorities do not always align with consumer demands, as they underappreciate the value of mobile wallets, personalized rewards, and satisfying customer services. Monolithic architectures and processes hinder banking ambitions, and foundational gaps in modernization and API standardization are hampering embedded finance outcomes. Privacy and security challenges also slow innovation across open ecosystems, with CEOs of financial institutions citing privacy and cybersecurity as the top two barriers to deployment.

According to Remy Carole, Chief Operating Officer at Treasury Prime, “Embedded financial services in products are starting to become commonplace. There’s a future where embedded finance is as ubiquitous as web technology is today.”

Figure 1: Embedded Finance is Becoming Popular Among Banking Operations

Benefits for Financial Institutions and Customers: Embedded finance offers numerous benefits to both financial institutions and their customers. By expanding transaction volumes rapidly, banks can improve their business performance and capture new customers.

According to Carmela Gómez Castelao, Head of Open Banking, BBVA, “Funding and development of embedded finance will only materialize if we seriously consider the changing behavior of our clients and therefore the change in people’s skills.”

The integration of financial services into non-financial platforms also enhances the user experience, making banking more convenient and accessible. Additionally, embedded finance opens up new revenue streams for banks, helping them diversify their offerings and drive sustained profitability.

Meeting the Ever-Evolving Customer Expectations: As consumers become accustomed to hyper-personalized experiences, they expect the same level of convenience and seamlessness when accessing financial services. With embedded finance, banks can meet these expectations by integrating their offerings into the customer journey. This can be achieved through secure application programming interfaces (APIs) that connect the bank’s services with non-financial platforms. By doing so, banks can position themselves at the heart of a successful business model that prioritizes customer-centricity.

Embracing the Digital Era: To remain competitive in the digital era, financial institutions must embrace the opportunities presented by embedded finance. By leveraging customer data and insights generated by artificial intelligence, banks can embed finance seamlessly into the client journey. This allows them to engage with customers on the digital platforms and marketplaces they already use, creating a more personalized and convenient banking experience.

Collaboration & Ecosystem Integration: In the era of embedded finance, traditional banking relationships have evolved from transactional to symbiotic. Financial institutions can no longer rely solely on their own product-centric value chains; they must also embrace ecosystem collaboration. By partnering with non-financial organizations, banks can expand their reach, tap into new customer segments, and create additional value for their clients. This collaboration allows banks to leverage the strengths of different players within the ecosystem, fostering innovation and driving business growth.

The Mainstream Adoption and Digital Banking Shift: The rise of embedded finance has coincided with the mainstream adoption of digital banking services. Consumers are increasingly applying for loans, managing investments, and purchasing insurance online. While traditional bank accounts still dominate, a significant portion of consumers are comfortable with fully digital, branchless propositions. This shift in consumer behavior further emphasizes the need for financial institutions to embrace embedded finance and provide seamless digital experiences.

Moreover, as generative AI takes center stage, it is essential to address these challenges to reap the benefits of the next industrial revolution. Ecosystem-based business models are rising, and embedded finance is transforming how consumers experience the digital world, with dramatic implications for financial institutions. In this context, banks need a clear embedded finance strategy to unlock new revenue streams successfully and remain competitive in the hyper-connected world.

Figure 2: The Proliferating Footprints of Embedded Finance

Exploring the Embedded Opportunities

To make the most of the opportunities presented by embedded finance, banks must address four key questions:

- 1.Are consumers ready to embrace banking in the platform economy?

- 2.Is embedded finance more than just a passing trend?

- 3.Where can banks remove friction to accelerate their digital transformation?

- 4.How can banks elevate their role within the ecosystem and deliver additional value to customers?

By answering these questions and leveraging the insights gained from consumer behavior, banks can position themselves as leaders in the embedded finance space.

Experience Transformation with MSys!

Diving headfirst into the future financial landscape, the market of embedded finance is projected to hit the marker of $7.2 trillion by 2030, evolving at a CAGR of 23.9% amid 2022-2030. Deploying it in your operations is largely seen as beneficial by about 94% of executive members – emphasizing its pivotal role in accelerating financial progress. When it comes to harnessing the incredible potential of embedded finance, look no further than MSys Technologies. As the unrivaled leader and the #1 embedded finance service provider in the USA, here’s how we leverage our expertise encompassing cutting-edge technologies and human ingeniousness to elevate your foray into embedded finance:

#1.Innovate your Infrastructure and Incorporate Emerging Container-Native Observability

To remain competitive in the digital era, financial institutions must embrace the opportunities presented by embedded finance. By leveraging customer data and insights generated by artificial intelligence, banks can embed finance seamlessly into the client journey. This allows them to engage with customers on the digital platforms and marketplaces they already use, creating a more personalized and convenient banking experience.

#2.Boost Your Engineering Workforce’s Efficiency with Our Robust-tech Stack

Incorporating embedded finance into your operations requires a robust tech stack that can handle the complexities of modern banking. MSys Technologies is a leading provider of embedded finance solutions in the USA, with a proven track record of delivering innovative and reliable services. Our avant-grade tech stack can boost your engineering workforce’s efficiency by up to 70%, enabling you to focus on creating value for your customers.

#3.Revitalized Product Sustenance Enhancing Return on Investment (ROI)

At MSys Technologies, we understand the importance of delivering high-quality services that meet your business needs. Our embedded finance solutions are designed to enhance your return on investment (ROI) by up to 35% on average, providing you with a competitive edge in the market. We offer revitalized product sustenance that ensures your solutions remain up-to-date and relevant, enabling you to stay ahead of the curve.

The rise of embedded finance has become ubiquitous throughout many industries as businesses continue to desire financial services in their platforms. Embedded finance can unlock an opportunity more significant than the current value of all fintech startups and the top global banks and insurers combined. As embedded finance has gained momentum, the fintech industry has become increasingly holistic about technology’s impact on businesses and consumers

We at MSys are committed to guiding you every step of the way, making your journey a resounding success.

The Role of Generative AI in Embedded Finance

“Amidst the digital horizon, Generative AI emerges as a radiant sunrise, casting its golden light upon Embedded Finance, illuminating an era of boundless possibilities.”

Generative AI is transforming the financial industry, enabling a host of innovative business models. It has completely transformed how financial data can be aggregated beyond a bank’s borders, making it possible to create more personalized and convenient banking experiences. When applied to embedded finance, generative AI can accelerate development, improve client experiences, and augment the knowledge of customer service representatives and financial advisors. Generative AI could take this transformation to the next level, making embedded finance platforms more adaptable than ever before.

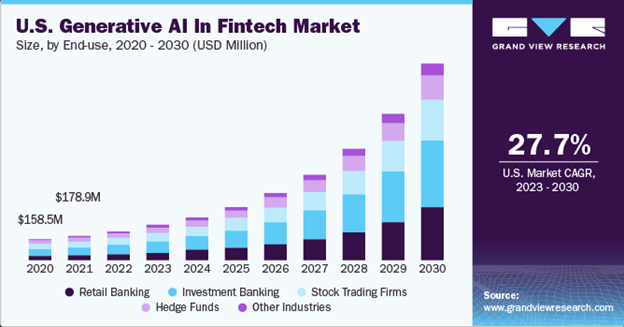

Figure 3: Generative AI Empowering FinTechs

According to a recent IBM survey, CEOs of financial institutions see business growth and expanded capabilities as the top benefits of adopting generative AI. While AI does boost efficiency, cost reduction isn’t a top priority. For example, 60% of CEOs say they expect generative AI to offer a competitive advantage or enhance customer experiences, but far fewer expect to reduce or redeploy headcount or decrease operational costs. The augmented workforce will play a primary role in capturing these opportunities, with 93% of executives saying they expect generative AI to augment employees across functions.

Overall, CEOs see more room for automation in direct client-oriented activities, such as marketing and customer services. However, financial services CEOs recognize that communication and human interactions are essential to client relationships. Compared to CEOs overall, they see more potential for automation in activities related to human resource management and information security rather than marketing and customer service.

Building trust in generative AI will be another essential step forward. Financial services CEOs say privacy and cybersecurity are the top barriers to adopting generative AI, followed by regulation. Banks will need to create a culture of responsible AI to overcome these obstacles, building on the principles of privacy, robustness, fairness, explainability, and transparency.

Driving Growth with Generative AI

AI powers the platform economy, and generative AI is driving growth in the financial industry. It has the potential to transform how leaders analyze data, manage risk, and optimize their operations. Many banks are exploring the opportunity for generative AI to help advisors retrieve the answers they need from financial product documentation.

Figure 4: The Generative AI Technologies Proliferating in FinTech Market

According to McKinsey, the advancement of AI technologies within financial services offers banks the potential to increase their operational efficiency and reduce costs. Generative AI has added a whole new dimension to what we mean by intelligent banking and the possibilities it creates to unlock more significant innovation and business value at an accelerated pace.

MSys Technologies’ Embedded Finance Services: Transcending the Future of Banking From Vision to Reality

MSys Technologies is a leading provider of embedded finance solutions in the USA, with a proven track record of delivering innovative and reliable services. Our immaculate tech stack can boost your engineering workforce’s efficiency by up to 70%, enabling you to focus on creating value for your customers. We, being the #1 embedded finance service provider in the USA, offer revitalized product sustenance that ensures your solutions remain up-to-date and relevant, enabling you to stay ahead of the curve.

As the #1 embedded finance service provider in the USA, we go beyond delivering static solutions; we offer ongoing revitalized product sustenance. This approach guarantees that your embedded finance solutions remain up-to-date and relevant in the face of an ever-evolving market. By staying informed and ahead of the curve with our support, you can ensure that your offerings continue to meet the changing needs of your customers.

Moreover, at MSys Technologies, we recognize the transformative potential of generative AI in the realm of embedded finance. Our expertise in artificial intelligence allows us to help you seamlessly integrate AI capabilities into your solutions. By harnessing the power of generative AI, you can unlock new levels of efficiency, scalability, and innovation, propelling your embedded finance offerings to new heights.

Removing Friction to Accelerate Transformation in Embedded Finance

“Embracing the rhythm of an ethereal waterfall, the absence of friction cascades through the tapestry of embedded finance, igniting a transformational symphony.”

Traditional banks, with their focus on security and reliability, often struggle to keep up with the demands for flexibility and speed in the digital era. As neobanks and digital institutions continue to challenge the competitive landscape, the need for faster innovation is more pressing than ever.

While many financial institutions have adopted embedded finance solutions or are in the process of doing so, the journey toward full transformation is not without its obstacles. Inflexible legacy systems, inefficient operating models, talent shortages, and limited long-term investment hinder progress and innovation.

The interconnected nature of embedded finance introduces new complexities. Transitioning from a closed organization that strictly manages the manufacturing and distribution of financial products to an open model, where banking products are embedded into a partner’s client journey, requires strategic thinking and collaborative operating models.

According to Quek Sin Kwok, Chief Digital Officer, Raffles Medical Group, “The success of achieving interoperability will rely on the collaboration and alignment of all involved parties, considering the standards, technology, and the alignment required for seamless information exchange.”

Foundational challenges often impede embedded finance strategies, including insufficient modularity of core banking systems, inadequate API standards, and insufficient long-term funding commitments. These issues must be overcome to enable banks to fully embrace the opportunities presented by embedded finance.

Figure 5: How Technology and tech-enabled companies outperform their Counterparts

Where Can Banks Remove Friction to Accelerate Transformation?

The foundation for any successful digital strategy is a modern business architecture. For embedded finance, embracing openness and flexibility is essential. Technical modularity and adoption of industry standards are crucial components for success.

According to Steve Hagerman, CIO of Consumer Technology, Wells Fargo, “Technology-only solutions will never be enough; your architecture must be synonymous with a clear business product taxonomy.”

Financial institutions that prioritize industry standards can add value in key areas:

- Accelerate Ecosystem Building: Adhering to standards enables rapid ecosystem building and seamless integrations with partner organizations, fast-tracking the growth and expansion of embedded finance offerings.

- Optimize Maintenance Efforts: By reusing APIs, financial institutions can significantly reduce development and maintenance costs, ensuring resources are allocated more efficiently and allowing greater focus on value-added initiatives.

- Streamline API Integrations: Embracing standards improves the partner experience during API integrations, rendering the process smoother and more efficient and fostering stronger collaboration and partnerships within the embedded finance ecosystem.

- Simplify and Streamline Deployment: Standards offer a coherent framework that simplifies and streamlines the deployment of embedded finance solutions. By adhering to these standards, banks can navigate complexities more effectively, allowing them to allocate resources and efforts towards higher-value activities, ultimately enhancing their offerings and customer experiences within the embedded finance space.

To drive competitiveness and success, banks must address strategic stumbling blocks such as misalignment between internal and external partners, due diligence gaps during onboarding, and slow use case development.

MSys Technologies specializes in helping banks remove friction and accelerate transformation in embedded finance. Our innovative solutions and robust tech stack empower banks to build faster, maintain better, integrate faster, and manage better. Partner with MSys Technologies, the #1 embedded finance service provider in the USA, and experience a transformational journey.

Capitalizing On Open Innovation for Amplified Efficiency in Embedded Finance

“As the curtains of possibility are drawn back, open innovation emerges, unveiling a mosaic of interconnected pathways, where finance flourishes like a majestic butterfly in a technicolor meadow.”

In today’s hyperconnected financial ecosystem, banks aren’t simply confined to their traditional core competencies. As vital nodes in an interconnected network of various stakeholders, banks must adopt and embody an open innovation mindset, paving a new way of operating. This progressive mentality encourages the application of open technologies that potentiate enriched business propositions, all the while ensuring secure and resilient embedded finance operations. With the info-flow becoming increasingly borderless, security becomes core and integral from the get-go.

On the path of partnership banking, financial institutions embrace a collaborative approach to co-design B2B2X business models and use cases centered around key client journeys by exploring new ways of delivering services beyond their own operations and stepping into the realm of architectural and operational transformation, characterized by the following key traits:

Third-Party Engagement

Third parties take ownership of the final client engagement, reducing friction for improved client experiences.

Strategic Collaboration

Financial institutions become strategic partners, working together with third parties to enhance client engagement and co-create solutions.

Demand for Speed

Partnering with influential fintech companies or major players in industries like big tech or e-commerce demands agile co-creation and development.

Reimagining Customer Experiences

Today’s customers crave hyper-personalized financial services. Artificial Intelligence, given its immense adaptability, has a vital role in injecting operations with noteworthy insights. This empowers banks to automatically fulfill customer needs with ideal solutions promptly. Further enhancing employee experiences can bolster overall customer satisfaction significantly.

Banking-as-a-Service (BaaS)

Providing a core banking platform to entities such as neobanks, large corporations, and small institutions.

Infrastructure and Branding

Third parties offer financial products and services under their own branding while using the partnering bank’s infrastructure and licenses.

Platform Orchestration

Creating a new venture to construct, implement, and manage a digital platform with the institution retaining ownership of financial services.

Upholding Environmental, Social, and Governance (ESG) Priorities

Through the new engagement models being embraced, enduring environmental, social, and governance priorities must be observed. Compliant embedded finance strategies call for an accurate and in-depth data analytical approach, facilitating resource optimization even beyond traditional banking measures. Integrating ESG propositions increases opportunities for enriched client engagement, such as helping them to evaluate the carbon effect of their transactions.

Bolstering Service Resilience

Given that embedded finance needs 24/7 platform availability, 37% of executives cite control and security framework gaps as of major concern during embedded finance strategy execution. Thus, banks must safeguard API services from cybersecurity perils and ensure workflow portability, mitigating risks associated with cloud provider concentration. Furthermore, both safeguarding data and maintaining processing sovereignty have emerged as fundamental demands.

Streamlining Transformation and Modernization

Many executives cite inadequate API standards and a lack of modularity in core banking systems as top roadblocks. However, modernization isn’t limited to maintaining IT—it’s about unlocking the potential that new thought processes and operational approaches offer. This transformation tends to facilitate faster time-to-market for business solutions stimulated by innovative ecosystem interactions.

Capitalizing on open innovation allows financial organizations to yield the full potential of embedded finance, strengthening their competitive position in the digital era.

Unlocking Success in the Ecosystem-Driven Banking Era: An Action Guide Distilled

At the heart of flourishing in the ecosystem-driven banking landscape lies the need for collaborative efforts across the entire spectrum of financial services. To embark on this transformative journey, ambitious banks are now seeking innovative solutions to cater to their client’s evolving needs, operating fluidly both within and outside traditional financial services. Driving this evolution requires the combined efforts of technology leaders, regulatory authorities, and CEOs championing a cultural shift.

This is where MSys Technologies, the leading embedded finance service provider in the USA, comes in, ready to offer invaluable assistance. Amidst the complexities of modern finance, MSys can help financial institutions navigate the landscape by providing comprehensive services that address unique challenges, enabling them to thrive in the ecosystem-driven era. Here’s how each role-holder can leverage MSys Technologies’ expertise:

CEOs: Fueling a Cultural Transformation

As the drivers of cultural transformation, CEOs play a pivotal role in envisioning and executing successful embedded finance strategies. With MSys Technologies as a steadfast partner, CEOs can:

– Facilitate joint visions: Hold senior leaders accountable for synergizing technology and business visions with long-term funding commitments and a strong sense of common purpose.

– Fostering Innovation: Cultivate a culture that fuels creativity, forward-thinking ideas, and diverse perspectives, supported by MSys’ innovative solutions tailored to each institution’s unique needs.

– Establish an Office of Value: Create a value-driven organization bridging IT and key business units. This critical entity is instrumental in achieving shared ROI targets, overseeing transformative initiatives, and recognizing milestones along the way.

– Trustworthy AI: Promote ethical AI practices to navigate the complex landscape of privacy and cybersecurity, with MSys Technologies’ expertise ensuring a solid foundation of trust.

Business Leaders: Implementing Tangible Strategies

Business leaders specializing in product strategy, operations, and innovation play a critical role in executing successful embedded finance initiatives. MSys Technologies supports business leaders’ endeavors by:

– Streamlining Financial Products: Leveraging MSys Technologies’ expertise to simplify financial products, harmonizing integration points with partner processes and external platforms.

– Ensuring Alignment between Business and Technology: Empowering technologists to actively contribute to strategic decisions, bridging the gap between business goals and technological capabilities.

– Developing a Playbook for Partnership: Collaborating with MSys Technologies to outline the embedded finance strategy, operational considerations, and shared performance indicators to unlock the power of partnerships and facilitate seamless collaboration.

– Breaking Data Barriers: Working alongside MSys Technologies, business leaders can strategize and implement initiatives to overcome data barriers across business lines. This empowers the organization to leverage privacy-compliant AI capabilities enriched by ecosystem-derived data and unlock its full potential.

Table 1: Empowering Financial Institutions: Summarizing MSys Technologies’ Value-Driven Support for Embedded Finance

| Role | Responsibilities | Challenges | MSys Technologies, the #1 Embedded Finance Service Provide in the USA, To The Rescue |

|---|---|---|---|

| CEOs | Lead Cultural Transformation/td> |

– Crafting joint business and technology vision – Promoting innovation and diversity – Establishing a value-driven office – Ensuring trustworthy AI |

– Hold senior leaders accountable for crafting a unified vision encompassing both business and technology.

– Secure long-term funding commitments and establish common objectives to unify all facets of the organization. – Cultivate a culture of innovation that treasures and nurtures creativity, forward-thinking concepts, and diverse perspectives from multifaceted teams. – Implement a value-centric restructuring of the institution by establishing a value-oriented office bridging IT and business functions. This office will drive the organization towards shared ROI objectives, supervise significant transformation projects, and recognize accomplishments. – Promote ethical AI practices to surmount privacy and cybersecurity challenges. |

| Business Leaders | Execute Embedded Finance Strategies |

– Simplifying financial products for integration – Aligning business and technology decisions – Developing a partnership playbook – Breaking down data barriers |

– Simplify financial products to facilitate their seamless integration into partner workflows. Ensure that integration points are user-friendly, adaptable, and compatible with a variety of external platforms.

– Empower technologists with a proactive role in making strategic business decisions, allowing them to align technology capabilities with business objectives. – Develop a comprehensive playbook to unlock the potential of partnerships. This playbook will outline the bank’s embedded finance strategy, operational considerations, and shared performance metrics. – Eliminate data barriers across various business lines to enable privacy-compliant AI throughout the organization, leveraging data from the ecosystem. |

Through its expertise and tailored solutions, MSys Technologies empowers business leaders to push beyond initial bets and drive the successful execution of embedded finance initiatives. By mitigating challenges and leveraging their services, financial institutions can accelerate their transition towards the everywhere, everyday bank.

Embrace the Future with MSys Technologies, the #1 embedded finance service provider in the USA. Together, we can lead your institution through the complexities of embedded finance and help you stay ahead of the curve.

Conclusion

“With the grace of a moonlit ballet, embedded finance pirouettes into the hearts of consumers, leaving behind ripples of transformative possibilities.”

Embedded finance, with its disruptive influx in the banking industry, could seem like an unfolding puzzle for many institutions. However, in revolution lies great opportunities for those ready to adapt and move with the times. When implemented effectively, you still walk the familiar grounds of finance, only with a more inclusive, widely encompassing, and intuitive approach. The principal goal is no longer to constrict banking to its conventional space but to integrate it into the daily lives of the end consumers ubiquitously.

Critically, with the digital age overseeing broad substitutes for traditional banking, enterprises’ relevance hangs over the extent to which they are ready to ride trends like embedded finance. This, indeed, is shaping how the consumer feels about the convenience of banking services.

This starkly punctuates where MSys Technologies – the #1 embedded finance service provider in the USA, sits predominantly.

Suppose you are at the helm of decision-making in an institution, big or small, and you’re shifting to a customer-faced interactive model of banking right amongst the marketplaces frequented by your clients. In that case, the expertise and innovative solutions these industry specialists provide are invaluable.

MSys Technologies isn’t just a leader but your key to navigating embedded finance’s complicated yet fascinating landscape. Find answers to growth as you get access to services that allow your consumers to experience seamless digital transactions right inside their comfort interfaces. For more information, talk to us.