Top 16 Use Cases for Generative AI in FinTech: Examples and Benefits

Audio : Listen to This Blog.

Introduction

“In the gusts of change, creativity surges, untangling the knots of convention with a delightful breeze creating a melodious cacophony.”

In the realm of financial technology (FinTech), the emergence of generative AI, a subset of artificial intelligence (AI), has sparked a wave of excitement and innovation. Its transformative potential is poised to reshape the landscape of FinTech operations. In this article, we delve into the multifaceted applications of generative AI. We’ll explore the top 16 key use cases for generative AI in FinTech that exemplify its profound impact on the industry.

Generative AI represents a breakthrough in the field of AI, building upon decades of innovation. Unlike other AI approaches, it not only classifies and identifies data but also learns from past information to generate entirely new content such as text, images, videos, computer code, and synthetic data. By harnessing this ability to create novel data, generative AI offers businesses an opportunity to optimize their processes, enhance efficiency, reduce costs, and allocate resources more effectively to core activities.

As industries seek to leverage generative AI for their specific needs, the competition intensifies, and executives grapple with a critical question: How can generative AI empower their businesses and confer a competitive advantage? This technology’s significance is evident in Goldman Sachs projections, which suggest that generative AI has the potential to propel the global GDP by an impressive 7%, equivalent to a staggering $7 trillion, within the next decade.

This projection aligns with the 2023 Gartner Emerging Technology and Trends Impact Radar, positioning generative AI, along with other self-supervised learning technologies, within the influential “Productivity Revolution” category.

Image Source: Gartner

In the following sections, we embark on a comprehensive exploration of generative AI’s use cases in FinTech. From cybersecurity and blockchain security to PKI-based identity, DDoS protection, and DNS security, we uncover how generative AI can fortify the digital infrastructure of financial technologies, safeguarding against threats and vulnerabilities. Additionally, we delve into its applications in two-factor authentication, Ethereum, and natural language processing (NLP), unraveling how generative AI can enhance user authentication, cryptocurrency ecosystems, and communication interfaces.

Furthermore, we explore how generative AI intersects with computer vision, asset management, neural network structures, and data augmentation. By harnessing the power of generative AI, FinTech companies can revolutionize the way they analyze visual data, optimize asset portfolios, design neural network architectures, and augment existing datasets to improve the performance of their AI models.

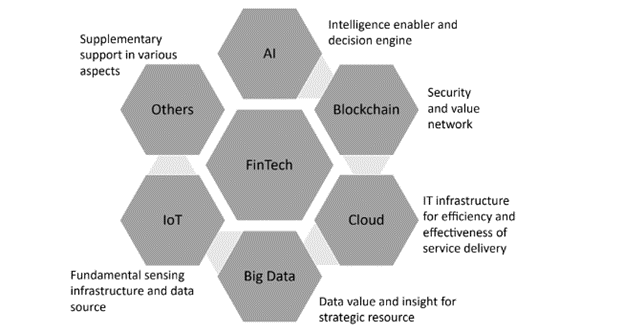

The Major Technologies Overarching FinTech

Through this exploration, we aim to illuminate the transformative potential of generative AI in the FinTech landscape. By embracing this technology, financial institutions can unlock new avenues of innovation, streamline processes, and gain a competitive edge in an ever-evolving industry.

Understanding Generative AI

“In the land of bytes and whimsy, invention sprouts like wildflowers beneath a digital moon.”

Before diving into the specifics, let’s first understand what generative AI is about. Generative AI refers to the use of algorithms and models to generate new data or content that is original and coherent. Unlike traditional AI models that rely on pre-existing data, generative AI has the ability to create entirely new outputs.

Generative AI is a fascinating field that combines the power of machine learning and creativity. It involves training models to learn from available data and then generate new content based on that training. These models can generate text, images, sounds, and more. The generated outputs are often indistinguishable from those created by humans, making generative AI a powerful tool for content creation and innovation.

What is Generative AI?

“Like a mischievous sprite, inspiration flits and darts through the corridors of the mind, leaving trails of innovative magic.”

Generative AI is a branch of artificial intelligence that focuses on the creation of new and original content. It involves training models to understand patterns within a given dataset and then using those patterns to generate new outputs. The goal of generative AI is to create content that is not only coherent but also innovative and unique.

One of the key advantages of generative AI is its ability to go beyond what already exists. Traditional AI models rely on pre-existing data to make predictions or generate content. Generative AI, on the other hand, has the ability to create something entirely new, pushing the boundaries of what is possible.

How Does Generative AI Work?

“Like a pixel samba, colors dance in vibrant syncopation, painting dreams upon the screen.”

Generative AI uses neural networks and advanced algorithms to analyze patterns within the training data. These patterns are then used to create new and original outputs. The models are trained using large datasets and complex algorithms, allowing them to understand and replicate the structure and style of the data they were trained on.

At the heart of generative AI are generative models, such as generative adversarial networks (GANs) and variational autoencoders (VAEs). These models are designed to capture the underlying distribution of the training data and generate new samples that follow the same distribution. GANs, for example, consist of two neural networks: a generator network that creates new samples and a discriminator network that tries to distinguish between real and generated samples.

During the training process, the generator network and the discriminator network play a game against each other, with the generator network trying to produce samples that fool the discriminator network. This adversarial training process helps the generator network improve its ability to generate realistic and coherent outputs.

Once the generative model is trained, it can generate new content by sampling from the learned distribution. For example, a text generation model can be trained on a large corpus of text and then used to generate new sentences or paragraphs that resemble the training data.

Generative AI has a wide range of applications, from creating realistic images and videos to generating music and even designing new products. It has the potential to revolutionize various industries, including entertainment, advertising, and design.

Image Source: LeewayHertz – AI Development Company

Building a Solid Foundation for Generative AI: Unveiling the Foundational Ecosystem

“Just as the sun gently caresses the earth, digital alchemy gives birth to unexpected wonders. The language of algorithms swirls and twirls, painting a masterpiece of creativity and ingenuity. Amidst this landscape, generative AI blooms like a captivating garden, where neural networks form mesmerizing fractal flowers. Each code line and data point paint a brushstroke on the canvas of possibilities!”

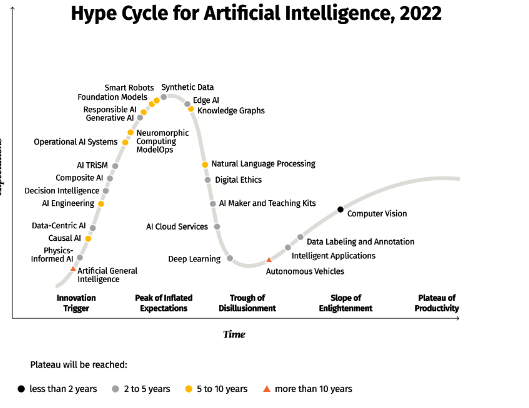

As you embark on your journey into the realm of generative AI and explore the potential of leveraging tools to support specific tasks, it becomes crucial to establish a solid groundwork for success. Gartner’s latest AI hype cycle reveals that generative AI is approaching the peak of inflated expectations. Industry leaders are still in the process of comprehending the underlying fundamentals of this technology, and investments in pilots and early adoptions may yield only incremental performance gains. Heightened expectations, fueled by media coverage and companies investing without a clear strategy or sound business case, have created a bandwagon effect. It won’t be long before we find ourselves entering the trough of disillusionment, as over-enthusiastic and hyped investments lead to adverse outcomes.

Image Source: Gartner

In light of this, why not learn from the predictable S-curve pattern and proactively prepare your organization to harness the potential of generative AI effectively? To ensure a successful journey through the slope of enlightenment, you must establish an ecosystem of three robust business capabilities that provide a fertile ground for generative AI to flourish.

This foundational ecosystem encompasses crucial elements such as data, processes, IoT (Internet of Things), and cloud infrastructure. By ensuring the availability of high-quality data, establishing streamlined and efficient processes, integrating IoT technologies, and leveraging the power of cloud computing, organizations can create an environment where generative AI can thrive. These interconnected capabilities work in synergy to support and enable the development and deployment of generative AI models.

By strategically aligning these foundational elements, organizations can lay the groundwork for successful implementation of generative AI. This approach allows for a conscious and well-prepared adoption, avoiding the pitfalls of overhyped investments and ensuring a smoother progression along the journey of generative AI adoption.

The Role of AI in FinTech

“As FinTech’s carousel spins, generative AI rides the prancing unicorn of disruption, trailing a trail of shimmering stardust that ignites the way for innovative pursuits.”

AI has become an integral part of the FinTech industry, transforming the way financial services are delivered. One of the key roles of AI in FinTech is automation. Financial institutions are using AI-powered chatbots and virtual assistants to provide 24/7 customer support, answer queries, and assist with basic financial tasks. This not only improves efficiency but also enhances the overall customer experience.

Fraud detection is another area where AI has made a significant impact. Machine learning algorithms can analyze large volumes of data in real time, identifying patterns and anomalies that may indicate fraudulent activities. This helps financial institutions detect and prevent fraud before it causes significant damage.

AI also plays a crucial role in providing personalized financial advice. By analyzing customer data, AI algorithms can offer tailored recommendations for investment strategies, budgeting, and saving goals. This level of personalization allows individuals to make informed financial decisions based on their unique circumstances and goals.

Risk assessment is another area where AI shines in the FinTech industry. Machine learning models can analyze historical data and market trends to assess the risk associated with various financial products and investments. This helps financial institutions make more accurate risk assessments and inform their decision-making processes.

The Impact of Generative AI on FinTech

“Bright as a thousand sun-kissed melodies, generative AI soars through the melodic currents of FinTech, its feathered brilliance casting a harmonious glow.”

Generative AI has the potential to revolutionize the FinTech industry in several ways. It can help companies streamline processes, improve customer experience, mitigate risks, and enhance decision-making.

With generative AI, FinTech companies can automate complex tasks that were previously time-consuming and resource-intensive. For example, generative AI algorithms can automatically generate financial reports, analyze market trends, and identify investment opportunities. This not only saves time but also reduces the risk of human error.

Customer experience is a top priority for FinTech companies, and generative AI can play a significant role in enhancing it. By analyzing customer data and preferences, generative AI algorithms can provide personalized recommendations and offers, improving customer satisfaction and loyalty.

Risk mitigation is another area where generative AI can make a significant impact. By continuously analyzing market data and monitoring transactions, generative AI algorithms can detect potential risks and anomalies in real time. This allows financial institutions to proactively prevent fraud, money laundering, and other financial crimes.

Furthermore, generative AI can enhance decision-making in the FinTech industry. By analyzing vast amounts of data and identifying patterns, generative AI algorithms can provide valuable insights and predictions. This helps financial institutions make informed decisions regarding investments, product development, and business strategies.

Overall, the integration of generative AI in the FinTech industry opens up new possibilities for innovation and growth. FinTech companies that embrace and leverage the power of generative AI can stay ahead of the competition, deliver cutting-edge solutions, and provide exceptional value to their customers.

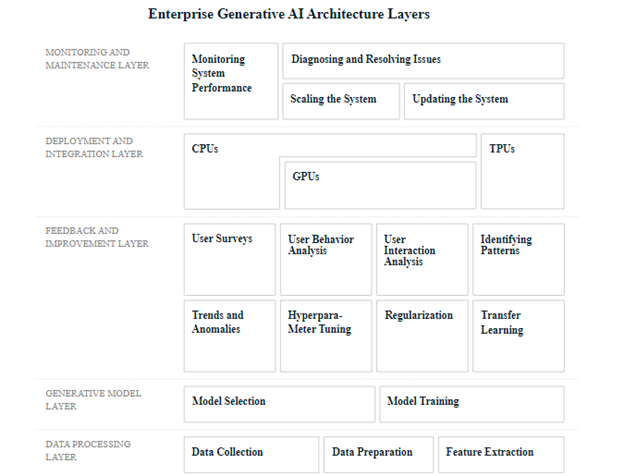

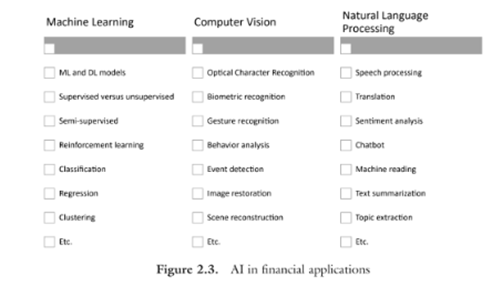

Scope of AI in Financial Applications

Top 16 Use Cases of Generative AI in FinTech

“In the technicolor dreamscape of FinTech wonderland, generative AI glimmers as the eccentric firefly, illuminating pathways to imagination and innovation.”

FinTechs, including Financial institutions such as banks, paytechs, wealthtechs, and proptechs, stand to benefit significantly from implementing generative AI. This cutting-edge technology has the power to revolutionize various aspects of customer service, enhancing personalized recommendations and enabling scalability in marketing efforts.

One area where generative AI holds immense promise is investment research. By efficiently generating a multitude of scenarios and simulating their outcomes, it can assist financial analysts and experienced traders in making informed decisions. The key lies in leveraging large language models (LLMs) trained on relevant data to provide valuable prompts.

Moreover, generative AI has the potential to benefit significantly financial professionals involved in compliance and capital markets. Access to LLMs specifically trained in regulations and financial documents would streamline processes and yield remarkable results in these areas.

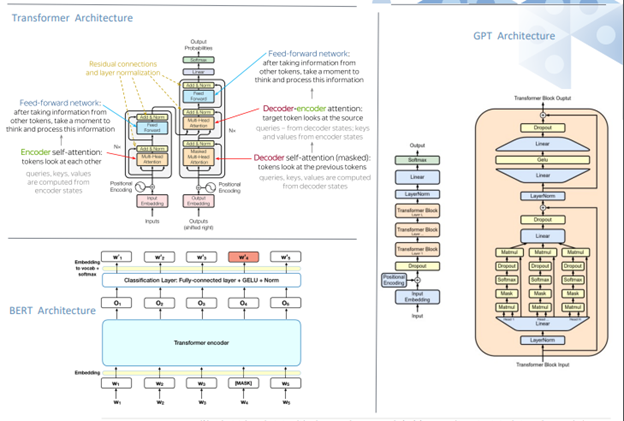

LLM Architecture Via Ashish Patel

By embracing generative AI, FinTech companies can leverage its potential in computer vision, asset management, neural network structures, and data augmentation. This transformative technology revolutionizes the analysis of visual data, optimizes portfolio management, enhances neural network architectures, and augments datasets to improve AI model performance. By harnessing the power of generative AI, FinTech organizations can unlock new avenues of innovation and gain a competitive edge in the rapidly evolving financial landscape.

Now, let’s delve into the top use cases of generative AI in the FinTech industry, showcasing how it can bring value and benefits.

Use Case 1: Fraud Detection

Fraud detection is a critical aspect of the FinTech industry, as it helps protect both businesses and customers from financial losses. Generative AI can be used to analyze large volumes of data and identify patterns that indicate fraudulent activities. By detecting fraud in real time, companies can prevent financial losses and maintain customer trust.

Use Case 2: Personalized Financial Advice

Generative AI can analyze user data, financial goals, and risk tolerance to provide personalized financial advice. Generative AI can help individuals make informed decisions about investments, savings, and financial planning by considering various factors and providing tailored recommendations.

Use Case 3: Risk Assessment

Risk assessment plays a crucial role in the FinTech industry. Generative AI can analyze historical data, market trends, and other relevant factors to assess the risk associated with financial transactions and investments. Companies can make informed decisions and minimize potential losses by accurately assessing risk.

Use Case 4: Algorithmic Trading

Generative AI can be used in algorithmic trading to analyze market data, identify patterns, and make real-time trading decisions. By leveraging the power of generative AI, companies can automate trading processes and execute trades based on data-driven insights, leading to improved efficiency and profitability.

Use Case 5: Credit Scoring

Credit scoring is an essential part of the lending process. Generative AI can analyze various data points, such as credit history, income, and spending behavior, to determine individuals’ creditworthiness. By automating the credit scoring process, companies can make faster and more accurate lending decisions.

Use Case 6: Customer Service Automation

Generative AI can be used to automate customer service processes, such as chatbots and virtual assistants. By understanding natural language and context, generative AI can provide personalized responses and assistance to customer queries, improving customer satisfaction and reducing the workload on customer service teams.

Use Case 7: Predictive Analysis

Generative AI can analyze historical data and market trends to make predictions about various financial aspects, such as stock prices, market trends, and customer behavior. By leveraging predictive analysis, companies can make data-driven decisions and stay ahead of market fluctuations.

Use Case 8: Loan Processing

Loan processing involves extensive paperwork and manual effort. Generative AI can automate the loan processing workflow by analyzing borrower data, verifying documents, and generating loan agreements. By streamlining the loan processing process, companies can reduce processing time, increase efficiency, and improve customer experience.

Use Case 9: Regulatory Compliance

Compliance with financial regulations is crucial for FinTech companies. Generative AI can analyze regulatory requirements and identify potential financial process gaps or violations. By ensuring regulatory compliance, companies can avoid penalties and maintain trust with regulatory authorities.

Use Case 10: Portfolio Management

Generative AI can assist in portfolio management by analyzing market data, investment strategies, and risk profiles. Generative AI can help investors optimize their portfolios and make informed investment decisions by providing real-time insights and recommendations.

Use Case 11: Strengthening Digital Security

Generative AI plays a pivotal role in fortifying the digital infrastructure of financial technologies, safeguarding them against a myriad of threats and vulnerabilities. Its applications span across cybersecurity, blockchain security, PKI-based identity, DDoS protection, and DNS security. By harnessing generative AI capabilities, companies can bolster their defenses, ensuring the integrity and confidentiality of sensitive financial data. Additionally, generative AI proves instrumental in enhancing user authentication, securing cryptocurrency ecosystems, and optimizing communication interfaces through two-factor authentication, Ethereum integration, and natural language processing (NLP).

Use Case 12: Evolution of Financial Services

The evolution of financial services has witnessed the rise of Asian Super Apps, such as WeChat, known as TechFins, rather than Fintechs. These platforms initially emerged as social messaging or mobility apps, eventually integrating financial services into their comprehensive offerings. This successful business model has been embraced in various regions, including China, Korea, Malaysia, Japan, and Kazakhstan. It is essential to differentiate this concept from marketplaces and platform-based ecosystems that merely incorporate non-core and financial services. Notably, popular entities like Paypal, Revolut, Apple, and Amazon do not fall under the category of Super Apps, despite their diverse features and penetration in retail and other businesses.

Use Case 13: Computer Vision Enhancement

Generative AI can revolutionize computer vision capabilities within the FinTech industry. By leveraging generative AI, companies can quickly analyze visual data, enabling automated image recognition, object detection, and facial recognition. This application allows advanced fraud detection, automated document processing, and enhanced user verification, ultimately streamlining processes and improving security measures.

Use Case 14: Optimal Asset Management

Generative AI empowers FinTech companies to optimize asset management strategies. By leveraging generative AI, organizations can analyze vast amounts of financial data, market trends, and risk profiles to generate insights and make informed investment decisions. This application helps portfolio managers identify potential investment opportunities, manage risk more effectively, and achieve better asset allocation, leading to improved performance and increased returns.

Use Case 15: Innovative Neural Network Structures

Generative AI plays a pivotal role in the design of neural network structures within the FinTech landscape. By harnessing its power, companies can optimize the architecture and parameters of their neural networks, improving model performance and accuracy. Generative AI enables the exploration of novel network architectures, such as deep neural networks, convolutional neural networks (CNNs), or recurrent neural networks (RNNs), enhancing predictive capabilities and enabling more sophisticated financial analysis and forecasting.

Use Case 16: Enhanced Data Augmentation

Generative AI can augment existing datasets within the FinTech industry, enriching the available data for training and validation purposes. By generating synthetic data points, generative AI helps overcome limitations imposed by scarce or imbalanced datasets. This application improves the performance and robustness of AI models by diversifying the training data and ensuring better generalization to real-world scenarios. With enhanced data augmentation, FinTech companies can make more accurate predictions, detect anomalies, and improve risk assessment.

Conclusion

“As the pendulum of progress swings, the symphony of generative AI resonates, harmonizing the FinTech realm with brilliance, like a secret serenade for the adventurous at heart.”

Evidently, generative AI has proven to be a game-changer for the FinTech industry, offering innovative solutions and enhancing various aspects of financial technology. The top use cases we’ve explored, from fraud detection to portfolio management, highlight the significant benefits that generative AI brings to the table. This transformative technology is set to shape the future of FinTech as the industry continues to evolve.

To your surprise and delight, there’s so much more MSys can offer to revolutionize your FinTech journey. MSys brings a whole new level of value-add to the table, from embedded finance to mobile applications and web-based solutions. We are not just another player in the FinTech spectrum; we are state-of-the-art artificers wielding technological ingenuity to facilitate revolutionary changes at the organizational level.

With MSys, you get access to a FinTech services team of 250+ skilled engineers who act as in-house superheroes and domain experts, ready to save your financial services business from cost overruns and inefficiencies. Our comprehensive expertise covers loyalty, payment processing, digital wallets, risk, fraud analysis, and more. We bring down the total cost of ownership by up to 45% through our fintech solutions, offering an amalgamation of technical brilliance and unwavering support 24/7/365.

Moreover, we provide complete testing services, a QA automation framework with thousands of test cases, and a CI/CD-powered solution for zero downtime updates. Our goal? To reduce your time-to-market while ensuring the highest quality of your products. With MSys as your trusted partner, you can conquer financial services hiccups and improve your business processes.

Ready to unlock new opportunities and use cases powered by Generative AI? MSys will guide you through opportunity mapping, helping you identify whitespace and core/adjacent market opportunities relevant to your tech vision and business strategy. Together, we’ll design your services and solutions based on your customers’ realistic needs and wants. With our partner intelligence, we’ll strengthen your core and gain additional tech capabilities through strategic build, buy, or partner strategies.

Competition is fierce, but with MSys, you’ll stay one step ahead. Our continuous market monitoring ensures we keep evolving to be one step ahead of key competitors’ tech capabilities and AI innovation strategies. And if you ever need guidance, our business consulting services are here to set up and enhance your systematic AI strategy, backed by robust research and advisory capabilities.

With MSys, you’re not just getting a partner – you’re getting a framework-driven approach to innovation. Our structured approach, backed by a robust framework, ensures problem-solving and actionable insights for your complex business needs. With our specialized end-to-end full-stack FinTech services, you embrace a digitized infrastructure powered by hybrid AI-enabled solutions that take the market and competitive intelligence to the next level.

Contact us today to unlock new opportunities and transform your FinTech journey!