Navigating the PayTech Landscape: Strategies for Embracing Alternative Payment Methods

Audio : Listen to This Blog.

Introduction

Alternative payment methods (APMs) have gained widespread acceptance in various global markets. As the payments landscape continues to evolve, issuers, acquirers, processors, and PayTechs must consider embracing APMs to stay competitive and meet the growing demands of consumers. In this blog, “Navigating the PayTech Landscape: Strategies for Embracing Alternative Payment Methods,” we will explore the key drivers behind adopting APMs and how businesses can leverage PayTech solutions to embrace these changes. Additionally, we will highlight industry case studies and success stories to provide insights into the benefits of embracing alternative payment methods.

What is PayTech?

PayTech is another word for the future of payments. Like “internet company,” the terms “fiat payment” or “offline payment” will soon be obsolete. Most payments will be online and digital and will therefore be based on technology. PayTech solutions are emerging on top of legacy infrastructure to offer innovative payment solutions such as digital wallets, super apps, A2A payments, and digital currencies.

The Rise of PayTech

PayTechs are a sub-group of FinTechs that are hyper-focused on the payment value chain, including payment facilitators, PSPs, networks creating new payment propositions, and payment technology suppliers. They offer integrated payment solutions seamlessly embedded into the digital economy, catering to the growing appetite for hassle-free payments. PayTechs were quick to recognize that fast and frictionless payments offer a distinct competitive advantage in the digital world, and they’re taking full advantage of it.

Key Drivers for Embracing APMs

Alternative payment methods (APMs) are gaining widespread acceptance in various global markets, and businesses must consider embracing APMs to stay competitive and meet the growing demands of consumers. In this blog, we will explore the strategies for navigating the PayTech landscape and embracing alternative payment methods.

Several key drivers are influencing the adoption of alternative payment methods:

- 1. Enhanced Customer Experiences: Consumers seek seamless payment experiences coupled with rewards and incentives. APMs offer innovative features that cater to these expectations, providing a competitive advantage for businesses.

- 2. Merchant Goals: Merchants aim to boost sales and lower payment acceptance costs simultaneously. APMs offer cost-effective solutions and enable businesses to expand their customer base by offering a variety of payment options.

- 3. Diversifying Payment Revenue: Payment providers are exploring avenues to expand their payment revenue streams. APMs offer new opportunities for monetization and revenue growth through transaction fees and value-added services.

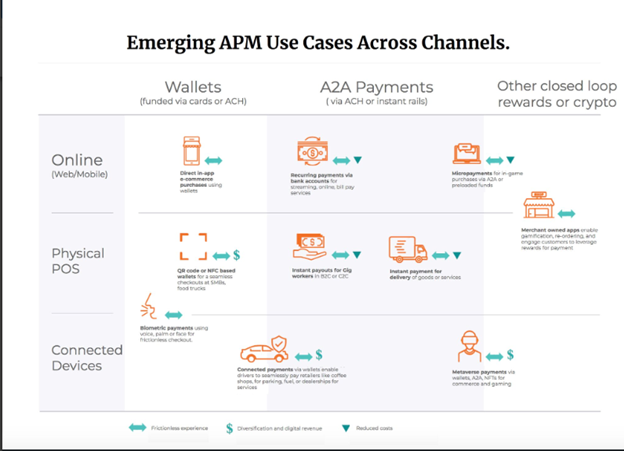

- 4. Diverse Use Cases: Different use cases and commercial contexts necessitate diverse offerings. APMs cater to specific needs, such as A2A payments through ACH for online recurring transactions or QR-code-supported wallets for physical point-of-sale scenarios.

Strategies for Embracing APMs

To seize the evolving dynamics of the payments landscape and bolster revenue, payment service providers should consider the following strategies for APM investment:

- 1. Segment Focus: Identify target business verticals and customer segments aligned with their needs and preferences to tailor APM offerings accordingly.

- 2. Operational Excellence: Strengthen back-office, risk, and compliance operations to provide robust fraud management and regulatory compliance capabilities.

- 3. Strategic Collaborations: Form partnerships with PayTechs and other payment ecosystem players to offer specialized services and decrease time-to-market for new APM solutions.

Embracing APMs can address common pain points in payment experiences, such as meeting consumer expectations for seamless payments, finding suitable payment technology partners, balancing security and convenience, gaining expert insights on payment experiences, and leveraging open banking for enhanced payment options.

Notable Statistics

- 87% of consumers express frustration with their payment experiences.

- Integration of a new payment method takes over 4 weeks for almost half (87%) of companies.

- Security is the top priority for 64% of consumers when making payments.

- Clear error messages are crucial for failed payments, allowing customers to understand the issues.

- Open banking offers enhanced user experiences and security amid rising online shopping and fraud concerns.

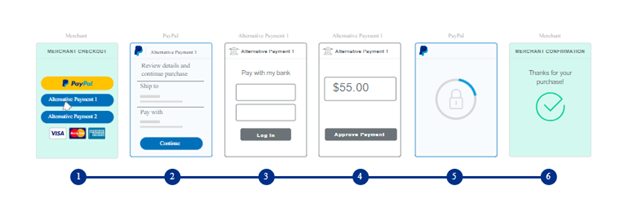

(Image Source: https://thepaypers.com/)

By navigating the PayTech landscape and embracing alternative payment methods, businesses can enhance customer experiences, optimize payment processes, and stay ahead in the rapidly evolving payments industry.

Use Cases and Case Studies of PayTech Landscape with Alternative Payment Methods

The rise of PayTech has disrupted the traditional payments landscape, and businesses are embracing alternative payment methods to enhance their payment experiences and drive revenue growth. Here are some use cases and case studies of the PayTech landscape with alternative payment methods:

Seven Revolutionary PayTech Renovations

PayTechs are responding to the expansion of the digital economy and customers’ rising expectations for an effortless payment experience by providing integrated solutions to both consumers and merchants. Here are seven revolutionary PayTech renovations that are shaping the future of payments:

- Contactless payments

- Mobile payments

- E-wallets

- Cryptocurrencies

- Embedded payments

- Real-time payments

- Open banking

The Determinants of PayTech’s Success in the Mobile Payment Market: The Case of BLIK

A case study of BLIK, a mobile payment system in Poland, found that PayTech’s success in the mobile payment market depends on several factors, including:

- User experience

- Security and Trust

- Availability and accessibility

- Integration with other services

- Marketing and promotion

Embedded Payments: The Future of Payments Is Invisible

As businesses move toward providing their customers with more personalized, frictionless experiences, embedded payments have become a core value proposition. Embedded payments are associated with business models where non-financial services companies offer payment functionality to their business customers. Embedded payments are becoming very common for all B2B2C and B2B2B business models like platforms and marketplaces, and PayTechs continue to play a major role in driving adoption rates.

Paving the Way for Payment Innovation

PayTechs offer integrated payment solutions seamlessly embedded into the digital economy, catering to the growing appetite for hassle-free payments. PayTechs quickly recognized that fast and frictionless payments offer a distinct competitive advantage in the digital world, and they’re taking full advantage of it. By providing innovative payment solutions such as contactless payments, mobile payments, e-wallets, and cryptocurrencies, PayTechs are shaking up the traditional payments landscape.

By embracing alternative payment methods and partnering with PayTech service providers, businesses can enhance their payment experiences, optimize payment processes, and stay ahead in the rapidly evolving payments industry.

Conclusion

The PayTech landscape is transforming radically, driven by the need for fast, frictionless, and integrated payment solutions. PayTechs, like caterpillars turning into butterflies, are leading the charge in shaking up the traditional payments industry. They offer innovative and convenient payment solutions that cater to the needs of both consumers and merchants, driving the evolution of the payments landscape.

By embracing alternative payment methods and partnering with PayTech service providers, businesses can enhance their payment experiences, optimize payment processes, and stay ahead in the rapidly evolving payments industry. Here are the key takeaways from navigating the PayTech landscape:

- 1. PayTechs are reshaping the payments landscape by offering integrated payment solutions seamlessly embedded into the digital economy.

- 2. The success of PayTechs in the mobile payment market depends on factors such as user experience, security, availability, integration, and marketing.

- 3. Embedded payments are the future of payments, providing personalized and frictionless experiences for customers.

- 4. PayTech innovations, such as contactless payments, mobile payments, e-wallets, and cryptocurrencies, are revolutionizing the payments industry.

- 5. Financial institutions can explore PayTech digital wallet strategies to extend value to their customer base.

- 6. PayTechs play a significant role in driving the adoption of embedded payments in various business models, such as platforms and marketplaces.

As the digital economy grows and customer expectations for seamless payments increase, embracing alternative payment methods and leveraging the capabilities of PayTech service providers will be crucial for businesses to thrive in the changing payments landscape.

In conclusion, navigating the intricate landscape of PayTech and embracing alternative payment methods requires a strategic approach that aligns with evolving market dynamics. PayTech solutions play a pivotal role in enhancing customer experiences, diversifying revenue streams, and addressing pain points in payment processes as the payments industry continues to evolve.

At the forefront of this transformation is MSys PayTech; MSys is an industry leader in end-to-end product engineering services that brings a comprehensive spectrum of expertise to the table. With a specialized focus on loyalty programs, payment processing, digital wallets, digital asset management, enterprise mobility, risk and fraud analysis, payment gateways, AI/ML integration, digital engineering, and SRE, MSys is well-equipped to cater to the ever-changing needs of the ever-evolving FinTech realm gamut at large and PayTech landscape.

Moreover, PayTech bifurcation is a guiding principle in segmenting the payments technology industry, ensuring that each category serves distinct functions to address the varied demands of businesses and consumers. Whether facilitating direct fund transfers through A2A payments, offering specialized payroll and HCM consulting, enabling seamless mobile payments, or providing essential services to non-bank entities through BaaS and Embedded Banking, the PayTech landscape is ripe with innovation and opportunities.

In essence, embracing alternative payment methods through PayTech is a journey that demands strategic insights, innovative solutions, and a commitment to enhancing the overall payment experience.