How Account-based ACH Payments are Streamlining Transactions in the USA

Audio : Listen to This Blog.

Introduction

Account-based ACH payments are a fast and secure way to transfer money between banks, credit unions, and other financial institutions. The benefits of account-based ACH payments include faster transfers of funds, greater security, and more options for paying your bills online or with mobile devices.

With the increasing reliance on digital transactions and the need for efficient payment methods, account-based ACH payments have emerged as a game-changer in the American financial landscape. Get ready to embark on a delightful journey filled with real-time use cases from across the globe and a touch of quirkiness that will leave you eager to embrace this authoritative payment method.

ACH payments have become a popular alternative to paper checks and credit card payments for businesses. Businesses can enjoy faster and more reliable payment processing by leveraging the electronic nature of ACH transfers, resulting in streamlined accounting operations. Moreover, processing ACH transfers typically incurs lower costs than credit card payments or wire transfers. This affordability is especially advantageous for businesses that handle recurring payments, leading to significant savings over time.

In this blog post, we’ll explore how account-based ACH payments are streamlining transactions in the USA and how these fast and secure transactions are revolutionizing how money is transferred between banks and financial institutions within the country.

Let’s dive in!

The Rise of Account-based ACH Payments

ACH, which stands for Automated Clearing House, is a significant financial network in the United States that facilitates electronic payments and money transfers—referred to as “direct payments,” ACH payments allow individuals to transfer funds from one bank account to another without the need for paper checks, credit card networks, wire transfers, or cash.

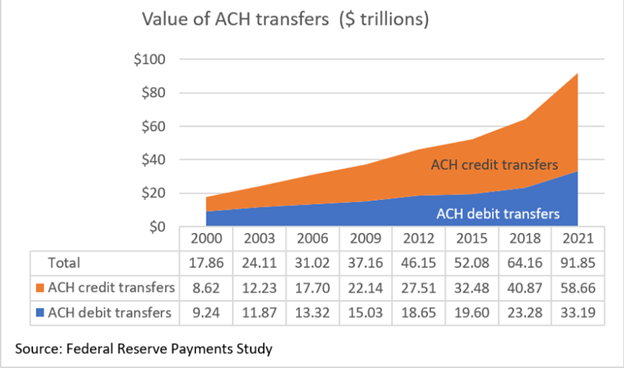

The volume of ACH payments has steadily increased, highlighting its growing significance. In 2016, the ACH network processed over 25 billion electronic payments, totaling a staggering $43 trillion; ever since, there has been notable growth in the ACH network year over year.

In 2021, the utilization of the ACH Network witnessed a remarkable surge, with payment volume experiencing an 8.7% increase, equivalent to an additional 2.3 billion payments compared to the previous year. Simultaneously, the value of ACH payments soared by 17.4%, amounting to an impressive $10.8 trillion, bringing the total to nearly $73 trillion. These figures signify the continuous growth and significance of ACH transactions, marking the seventh consecutive year with a billion or more additional payments and the ninth year in which payment value surpassed a trillion-dollar increase.

The advantages of ACH payments extend beyond their sheer volume and value. They offer substantial cost savings, as the Association for Finance Professionals’ Annual Payments Cost Benchmarking Survey highlights. For most businesses, the average cost of an ACH payment ranges between 26 cents and 50 cents, significantly lower than the median cost of paper checks, which ranges from $2.01 to $4 across the board. The survey considered various factors, including processing fees and personnel expenses, to calculate the comprehensive cost of each transaction. These figures show that ACH payments present a clear opportunity for substantial savings without requiring complex calculations.

ACH Transfers in Trillions and Card payments (experiencing a more rapid increase in value compared to previous years, with a growth rate of 10% annually from 2018 to 2021).

If you’re unfamiliar with the terminology, chances are you’ve already encountered ACH payments as a consumer. If you pay your bills electronically rather than writing checks or entering credit card details, or receiving direct deposits from your employer, the ACH network is likely behind these transactions, working efficiently behind the scenes.

Picture this: you’re tired of waiting in long bank queues or dealing with complicated wire transfers. Enter account-based ACH payments, the superhero solution that streamlines transactions with speed and security. Originally developed in the 1960s, this unconventional payment method allows consumers and businesses to effortlessly move money between accounts without the need for bank tellers or excessive waiting times. It’s like having a personal financial assistant who knows how to get things done!

How Account-based ACH Payments are Streamlining Transactions in the USA

Account-based ACH payments offer a faster and more secure way to transfer funds between banks and financial institutions. Here’s how they are revolutionizing the payment landscape:

- 1. Faster and more secure transfers: Account-based ACH payments eliminate the need for traditional methods like waiting in bank queues or dealing with complex wire transfers. Developed in the 1960s, ACH payments allow consumers and businesses to effortlessly move money between accounts without the need for bank tellers or excessive waiting times.

- 2. Widely used by businesses and consumers: Account-based ACH payments are not limited to consumer transactions. Businesses also rely on them to send money between accounts at different financial institutions, domestically and internationally. It has become a popular choice for payroll purposes as well.

- 3. Minimal information required: ACH transactions typically require only the customer’s name and address, making them convenient for hassle-free transfers. However, for international wire transactions, additional details may be necessary.

- 4. Enhancing efficiency and security: By leveraging the ACH system, account-based payments streamline transactions, reducing processing times and increasing efficiency. These transactions occur online, enhancing security compared to traditional methods such as paper checks or debit cards. Encryption technology ensures the protection of sensitive information during online purchases.

Thus, account-based ACH payments have become a pivotal method for faster, more secure, and efficient fund transfers between banks and financial institutions. They offer convenience, flexibility, and peace of mind for businesses and consumers alike.

Benefits of Account-Based ACH Payments

Account-based ACH payments offer numerous advantages, including:

- 1. Faster transfers of funds: With account-based ACH payments, transactions occur directly between bank accounts, eliminating the need for additional processing time. This enables swift transfers, ensuring that both the sender and receiver receive immediate notifications regarding the availability of funds.

- 2. Scaled security: Account-based ACH payments provide enhanced security compared to traditional methods. By conducting transactions online and leveraging encryption technology, users have more control over their personal information and can mitigate risks associated with physical mailings or vulnerable networks.

- 3. Convenient bill payments and fund transfers: Account-based ACH payments make paying bills and transferring funds between accounts effortless. Whether you’re settling invoices online or managing financial obligations, these payments offer a convenient and efficient solution.

- 4. Swift processing time: Enjoy the speed of account-based ACH payments, which can be processed within minutes. Say goodbye to long waiting periods and experience hassle-free transactions.

- 5. Streamlined financial interactions: Embrace the ease and efficiency of account-based ACH payments, eliminating the frustrations of lost checks and paper invoices. Simplify your financial interactions with the help of this unconventional payment method.

Thus, Account-based ACH payments offer flexibility and infuse a whimsical array of benefits, simplifying financial processes.

Streamlining Account-Based ACH Payments with Proprietary Software Solutions

Setting up account-based ACH payments may seem complex, but some smart software vendors have streamlined the process for both senders and receivers. For instance, Rotessa allows businesses to collect invoices and recurring bank account payments (direct debit ACH) for businesses GoCardless offers ACH payments and specializes in recurring payments and invoicing PaymentCloud services both ACH payments and credit card payments SeamlessChex, and Stripe ACH, Helcim, and TelPay are other examples of software vendors that provide proprietary software that simplifies the setup process.

With the assistance of these software vendors, account-based ACH payments become more accessible, ensuring your financial interactions are efficient and stress-free. Benefit from their user-friendly solutions and enjoy a seamless payment experience.

Account-based ACH payments are revolutionizing the transfer of funds between banks and financial institutions, offering speed, security, and flexibility for individuals and businesses alike. Embrace this innovative payment method and experience the transformative power it brings to your financial transactions.

Some Use Cases of Account-Based ACH Payments from Around the Globe

Let’s discover how account-based ACH payments are transforming financial transactions worldwide with these real-time success stories:

- 1. Trendy Coffee Shop in New York City: In bustling New York City, a trendy coffee shop has embraced account-based ACH payments, allowing customers to pay directly from their bank accounts. This eliminates the need for cash or card transactions, providing a seamless and convenient payment experience.

- 2. Freelance Designer in Vibrant London: In vibrant London, freelance designers receive instant payouts for their creative work through account-based ACH payments. By leveraging this payment method, the designer can easily access their hard-earned funds, eliminating delays or waiting periods.

- 3. Subscription-Based Businesses: Subscription-based businesses and firms charging insurance premiums regularly use ACH debits for recurring payments.

- 4. High-Value Payments: ACH debits have lower fees than credit or debit card payments, making them cost-effective for high-value transactions.

- 5. B2B ACH Debit Payments: Many businesses now use ACH debits for B2B transactions.

These global use cases demonstrate the transformative power of account-based ACH payments in facilitating smooth and reliable money transfers.

Conclusion

In conclusion, account-based ACH payments are different from your typical financial transactions. They’re the quirky and exciting adventure you’ve been waiting for! Their speed, security, and flexibility are revolutionizing how money moves between banks and financial institutions in the USA. From real-time use cases globally to the whimsical benefits and simplified processes, account-based ACH payments offer an extraordinary solution.

However, setting up an account-based ACH payment may seem as complex as solving a Rubik’s Cube underwater. Fear not; we have the perfect solution to unlock this enigmatic puzzle. Enter MSys FinTech team, the heroic provider of fintech services that cover the entire banking and payments spectrum. From embedded finance to personal financial management, lending to international money transfers, and everything in between, MSys’ full-stack FinTech services are your one-stop destination.

Imagine wielding the power of financial APIs, mobile applications, and cloud computing in the palm of your hand. With MSys FinTech, you’ll effortlessly set up and manage your account-based ACH payments, ensuring a seamless and secure fintech experience: no more stress or confusion, just smooth sailing through the financial seas.

Take your chance to streamline your transactions and embark on a genuinely quirky financial journey. Reach out to MSys FinTech today and unlock the possibilities of account-based ACH payments. It’s time to say goodbye to old-fashioned methods and say hello to a world of financial magic. Contact us now and let MSys FinTech be your trusted guide through this extraordinary adventure!