FinTech’s Natural Selection: The Top Qualifying Fittest Trends for 2024

Audio : Listen to This Blog.

Prelude: A Straw In the Wind

As the market curtain rises on ‘FinTech’s Natural Selection: Top Qualifying Fittest Trends for 2024,’ our FinTech protagonist, reminiscent of Iron Man’s strategic genius, emerges undaunted from the survival slumber of Q3 2023. No longer a lone wanderer, but the Captain of an Avengers-like alliance, our protagonist orchestrates a cinematic saga of resilience and innovation. With the tactical prowess of Iron Man’s suit in regulatory technology, the charisma of Marty McFly driving payment companies forward, a strategic dance reminiscent of Ocean’s Eleven in mergers and acquisitions, and the transformative powers of AI and blockchain, we witness a blockbuster narrative where every setback transforms into a triumph. The stage is set for a financial tale that transcends new horizons, echoing the iconic tales of American heroes on the silver screen. Our FinTech protagonist is not just a solitary reaper but part of a thriving posse, with global market growth painting the town with promises of prosperity. It’s not just a financial story; it’s a rodeo of resilience, innovation, and a stampede towards endless possibilities, y’all!

Resurgence Rhapsody: FinTech’s Epic Reckoning Poised for the Cinematic Triumph of 2024

The FinTech industry is poised for a recovery in 2024 after facing challenges in Q3 2023.

The FinTech industry faced several keen challenges in Q3 2023, which are expected to be overcome in 2024. These challenges included funding slowdowns, valuation haircuts, an economic downturn, rising interest rates making borrowing more expensive, and increased pressure to implement AI into product offerings. Additionally, there was a heightened level of regulatory oversight, changing regulations concerning data privacy, cybersecurity, and financial services, and an increase in cybercrime, particularly in the FinTech sector. The industry also experienced a decline in funding and faced obstacles to growth, such as longer sales cycles and declining win rates. However, despite these challenges, the industry is expected to overcome them in 2024, with a focus on regulatory technology, growth in payment companies, increased merger and acquisition activity, and the application of new technologies like AI and blockchain to navigate the changing landscape. This blog, “FinTech’s Natural Selection: The Top Qualifying Fittest Trends for 2024,” delves into the dynamic world of FinTech in 2024, shedding light on the industry’s top trends and navigating beyond the survival challenges of Q3 2023 to embark on new horizons.

FinTech’s Meteoric Rise In 2024: Top Fittest Trends Fueling Growth and Innovation

According to McKinsey, revenues in the FinTech industry are expected to grow almost three times faster than those in traditional banking, indicating a strong recovery. Despite setbacks in 2023, the industry is expected to experience significant growth, with a Statista report projecting global market growth from $127.65 billion in 2022 to $332.3 billion in 2024. Additionally, there is an anticipation of increased merger and acquisition activity, as well as a focus on regulatory oversight and the application of new technologies like AI and blockchain. These trends suggest a resilient and evolving FinTech landscape, with opportunities for growth and innovation in the year ahead.

Let’s explore the pivotal FinTech trends set to define the industry in 2024 and beyond powering growth and innovation such as intelligent automation, AI-driven advisory, generative AI applications, blockchain synergy, big data analytics, the integration of embedded financial solutions, and many more:

GenAI Ascendancy: FinTech’s Magnetic Trend for 2024

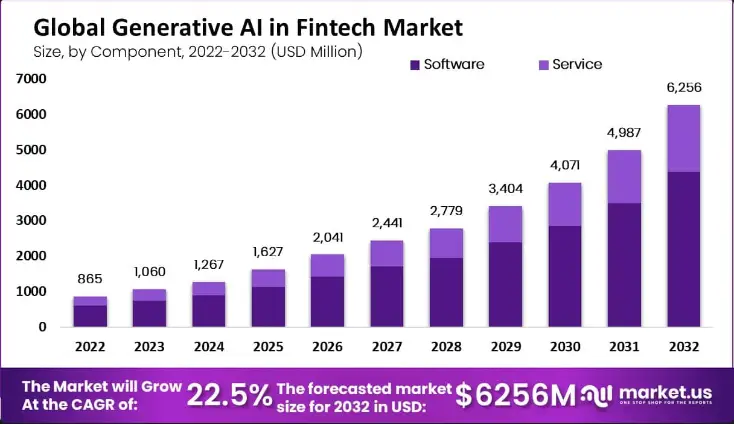

GenAI in FinTech is one of the top fittest trends for 2024, with the use of AI and machine learning in FinTech expected to increase with the development of more sophisticated algorithms and predictive models. From banking to risk management, GenAI transforms services, drawing on years of evolution in financial technology. Omdia’s survey unveils the industry’s eager embrace, with 93% of banking already exploring AI adoption. The future beckons with GenAI accelerating in risk and compliance, enhancing precision, and reshaping user experience through innovations like chatbots and mass customization. As we approach the unleashing of GenAI, the industry tackles biases and aims for transparency with explainable AI (XAI). The industry is witnessing vanguards like OpenAI’s ChatGPT and Vivela, a FinTech company pioneering personalized financial advice by leveraging AI and machine learning.

Figure 1. Generative AI for FinTech

OpenAI recently introduced the GPT Store, a marketplace catering to paid ChatGPT users for buying and selling specialized chatbot agents based on GPT models. This platform expands users’ capabilities, enabling the creation and monetization of a diverse range of tools, from models for salary negotiation to crafting lesson plans and developing recipes. Often likened to Apple’s App Store, the GPT Store encourages fresh AI development from a broader user base. As part of OpenAI’s strategy to stay at the forefront of the AI landscape, they also plan to roll out a revenue-sharing program, compensating builders based on user engagement with their GPTs. The GPT Store is anticipated to unlock novel opportunities for developers and users within the AI and chatbot realm, exemplifying OpenAI’s commitment to rapid evolution in this dynamic field of AGI, thereby revolutionizing technology and FinTech.

In 2024, the use of Generative AI in FinTech is set to redefine the industry, paving the way for secure, efficient, and convenient banking, while unveiling vast avenues for growth and innovation. This transformation is expected to accelerate in key areas such as Risk and Compliance, where it will help in identifying bad actors and enhancing user experience through chatbots and mass customization.

Dawn of Eco-Finance: FinTech’s Ongoing Embrace of Sustainable and Green Financing

Witness the surge as FinTech firms lead the charge, offering innovative products to foster environmental sustainability. The momentum, first set in Europe, now grows, anticipating a similar wave in the United States with recent regulatory developments. FinTech emerges as the catalyst, guiding banks, companies, and consumers toward ‘net zero.’ Beyond financial support, FinTech’s role extends to environmental impact assessment for companies and inspiring investors to align with sustainable operations. Several pieces of research explore the comprehensive impact on economic development, pointing towards enhanced efficiency and structural transformation.

Embarking on a transformative journey, the realm of green financing in Europe and North America reveals a tapestry woven with remarkable statistics and commitments from financial titans:

- McKinsey’s visionary report forecasts a staggering surge in Europe’s FinTech landscape, anticipating a growth factor of 2.7, resulting in over 364,000 new jobs. The funding volume is poised to more than double, reaching nearly €150 billion from €63 billion, and valuations are set to soar by a factor of 2.3, nearing €1 trillion—almost double the combined market capitalization of Europe’s top ten banking players as of June 2022.

- Across Europe, a green banking revolution is underway, fueled by robust regulations and legislation. A wave of change is also sweeping across the United States, propelled by recent regulatory and legislative developments centered around disclosures and climate-focused incentives.

- Statista’s data unveils the substantial market size of green, social, and sustainability (GSS) bonds in Europe, standing at an impressive $5.9 billion as of 2021.

- In North America, financial powerhouses are making resolute commitments to climate solutions and sustainable development. JPMorgan Chase is steering towards financing $2.5 trillion by 2030, while Goldman Sachs aims to invest $150 billion in companies promoting sustainable finance. Bank of America, equally committed, pledges to mobilize an additional $1.5 trillion in capital to expedite the transition to a low-carbon, sustainable economy.

- Global financial juggernauts are stepping up to the sustainability plate. BlackRock, the world’s largest asset manager, charts a course for achieving net-zero emissions across its entire investment portfolio by 2050. UBS, in a bold move, pledges to invest $10 billion in sustainable endeavors over the next decade. BNP Paribas commits to ceasing financing for thermal coal mines and coal-fired power plants in the European Union, the United States, and OECD countries by 2030.

This compelling narrative of growth and commitment unfolds against a backdrop of changing financial paradigms, ushering in a future where green finance stands at the forefront of global economic evolution.

While FinTech unveils opportunities, the journey towards building a sustainable economic framework raises questions, paving the way for further investigation. Leading the charge are FinTech innovators and financial institutions, poised to shape 2024 as a year where sustainable and green financing drives economic excellence and environmental responsibility.

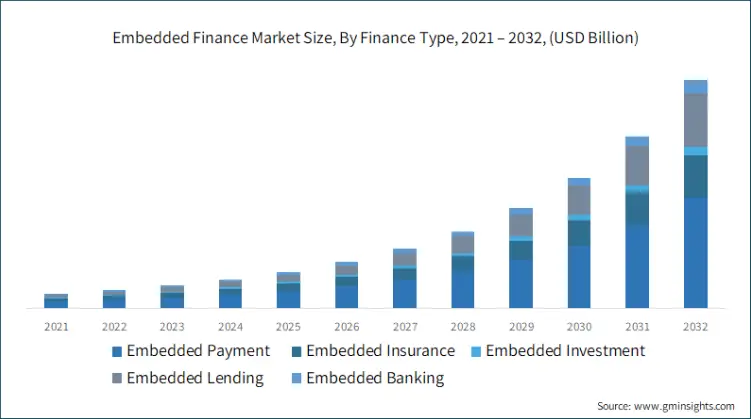

Revolutionizing Finance: The Explosive Rise of Embedded Financial Solutions

Unveiling the next wave in financial evolution, Embedded Finance emerges as a rapidly expanding trend, foretelling the integration of financial tools within the offerings of non-financial companies. The year 2024 is poised to witness a surge in this trend, with a myriad of companies stepping into the arena to offer innovative financial services to their customers.

In a groundbreaking report by McKinsey, the integrated experience of Embedded Finance has propelled revenues to a staggering $20 billion in the United States alone in 2021. Astoundingly, the market size could double within the next three to five years, charting a trajectory towards unprecedented growth.

Figure 2. The Proliferation of Embedded Finance

The landscape of Embedded Finance unfolds with limitless possibilities—customer loyalty apps, digital wallets, accounting software, and shopping-cart platforms among them. For consumers and businesses navigating these interfaces, acquiring financial services seamlessly intertwines with non-financial experiences like online shopping, employee scheduling, or inventory management.

Accenture sheds light on the corporate side of Embedded Finance, revealing that platforms are strategically targeting SME customers with these financial offerings. A global SME survey indicates a potential shift in the near future as digital platforms set their sights on SMEs with Embedded Finance.

Key players in this revolutionary space include Bolt, an e-commerce checkout software provider, and Goodleap, an app connecting consumers with lenders and sustainable home improvement companies.

Beyond borders, the European FinTech landscape anticipates remarkable growth, with projections including a factor of 2.7 growth in FinTech jobs, funding volume more than doubling to almost €150 billion, and valuations reaching almost €1 trillion.

In North America, financial juggernauts such as JPMorgan Chase, Goldman Sachs, and Bank of America are making monumental commitments. JPMorgan Chase is steering towards financing $2.5 trillion in climate solutions by 2030, while Goldman Sachs pledges to invest $150 billion in sustainable finance. Bank of America is equally committed, mobilizing an additional $1.5 trillion in capital by 2030 to accelerate the transition to a low-carbon, sustainable economy.

While the Embedded Finance ecosystem is still maturing in many emerging markets, China stands out as a pioneer with its ‘Super-apps,’ capturing an overwhelming market share.

In the tapestry of financial transformation, Embedded Finance emerges as the protagonist, promising a dynamic future where financial services seamlessly integrate into the fabric of everyday experiences.

Banking Revolution Unleashed: The Soaring Wave of Banking as a Service (BaaS)

Embarking on a transformative journey, Banking as a Service (BaaS) emerges as a formidable model empowering non-bank companies to seamlessly offer banking services to their clientele. The year 2024 heralds a continued surge in this trend, with a growing influx of companies venturing into the BaaS market.

The BaaS landscape is poised for remarkable growth, with a projected Compound Annual Growth Rate (CAGR) of 26.60% from 2024 to 2029. The market’s colossal size is estimated to soar to USD 14.72 billion by 2029, ushering in a new era of financial innovation². Europe spearheads the BaaS domain, with the United Kingdom commanding approximately 25% of the market share within Europe. Anticipating sustained growth, the European BaaS market is projected to witness a robust CAGR of >7.00% from 2023 to 2028.

Diving into segmentation, the BaaS market distinguishes itself across components (platform and service), types (API-based BaaS and cloud-based BaaS), enterprise sizes (large enterprise and small & medium enterprise), and end-users (banks, NBFC/FinTech Corporations, and others). Key players in the European BaaS market, including Treezor, Solarisbank, Railsbank, and Fidor Solutions, are steering the industry toward unprecedented heights.

Crossing the Atlantic, North America anticipates a staggering CAGR of >30.00% from 2021 to 2026 in the BaaS arena. Finastra, FIS, and Jack Henry & Associates emerge as pivotal players shaping the North American BaaS market.

In emerging markets, a parallel narrative unfolds, with the BaaS market projected to witness a robust CAGR of >30.00% from 2021 to 2026. Amazon Web Services, Google, and Microsoft take center stage as major players in the burgeoning BaaS landscape.

The BaaS market’s upward trajectory is anchored in the increasing adoption of digital banking solutions, fostering simplicity, efficiency, and cost-effectiveness for banks and service providers¹. The integration of artificial intelligence, blockchain technology, and API services within internet banking emerges as a catalyst propelling market growth.

So, it’s time to embrace the BaaS revolution—a paradigm shift in banking that promises innovation, accessibility, and efficiency.

Revolutionizing Finance: The Soaring Wave of Alternative Financing

Let’s dive into the future of finance with Alternative Financing, a groundbreaking trend encompassing non-traditional methods like crowdfunding and peer-to-peer lending, set to flourish in 2024 with an array of companies offering innovative financing options.

In 2022, Statista projected the total transaction value in the Alternative Lending segment to reach an impressive US$8,684.9m, with marketplace lending reigning as the largest market segment. Brace for an annual growth rate of 2.4% (CAGR 2021-2025) propelling the alternative lending sector into new heights.

Across the globe, regions are gearing up for unprecedented growth. In Europe, anticipate a robust CAGR of 13.3% during the forecast period 2021-2026. Meanwhile, North America is set to experience a substantial CAGR of 10.5%, and emerging markets are poised for remarkable growth at a CAGR of 12.5%.

Navigating the alternative financing landscape unveils key players like LendingClub Corporation, Prosper Marketplace, Inc., Funding Circle Limited, and others who are orchestrating the financial transformation.

As we embark on 2024, the alternative financing market is anticipated to burgeon further, fueled by the escalating demand for diverse financing options, the meteoric rise of crowdfunding platforms, and the increasing number of small and medium-sized enterprises (SMEs) seeking alternative financing avenues.

Indeed, Alternative Financing is not just a trend; it’s a transformative force reshaping the landscape of finance.

Unleashing Financial Frontiers: The Epic Rise of Open Banking

Open Banking takes center stage in 2024 — it’s a transformative practice allowing third-party developers to craft applications around financial institutions using open APIs. Brace for an exhilarating journey as this trend continues its meteoric rise in 2024, with a growing number of companies embracing the open banking paradigm.

In 2024, the banking industry faces a crucible of challenges, as outlined by Deloitte’s comprehensive report. Strategic choices will be tested amidst a slowing global economy, unveiling disruptive forces reshaping the industry’s foundational architecture—from higher interest rates and reduced money supply to assertive regulations, climate change, and geopolitical tensions.

The global open banking market is a juggernaut, catapulting from $15.13 billion in 2021 to a staggering $19.14 billion in 2022, boasting a compound annual growth rate (CAGR) of 26.5%. Brace for even more phenomenal growth, with the market projected to soar to $48.13 billion by 2026 at a robust CAGR of 25.9%. The FinTech industry is witnessing the ascendancy of North America, reigning as the largest region in the open banking market in 2021.

Europe emerges as the epicenter of open banking, boasting approximately 12.2 million users in 2020, set to skyrocket to a monumental 63.8 million by 2024. The spectacle extends to emerging markets, poised for a phenomenal annual growth rate of nearly 50 percent in open banking users worldwide between 2020 and 2024.

Among the titans shaping this financial saga are Plaid, Yodlee, Tink, and TrueLayer. Brace for an unparalleled financial adventure where the realm of Open Banking reshapes the very fabric of our financial landscape.

Revolution Unleashed: Blockchain’s Dominance in Finance

Embark on a seismic shift in the financial landscape as blockchain technology surges ahead, captivating the financial sector with its potential for secure and transparent transactions. In the daring narrative of financial disruption, a Forbes revelation declares that blockchain not only disrupts but creates an entirely new market, offering a lifeline to the unbanked, scaling faster, reducing costs, and ensuring heightened security.

Blockchain plays a pivotal role in shaping the financial future, heralding an era of revolutionary transactions marked by improved efficiency, reduced costs, and enhanced security. McKinsey’s insights amplify this revelation, foreseeing blockchain’s potential to create new business opportunities by mitigating risks, slashing compliance costs, automating secure contract fulfillment, and enhancing network transparency.

Anticipate a meteoric rise as the blockchain-based FinTech market hurtles towards a valuation of USD 6700.63 Mn by 2023, propelled by an awe-inspiring CAGR of 75.2%. There’s an arms race among FinTech giants vying to craft the ultimate blockchain platform, tailored for a myriad of transactions in diverse contexts.

Assuredly, 2024 will be a testament to blockchain’s transformative dance across cryptocurrencies, DeFi, smart contracts, supply chain management, and beyond.

Let this be your guide to the frontier where blockchain’s disruptive force shapes the financial destiny of tomorrow.

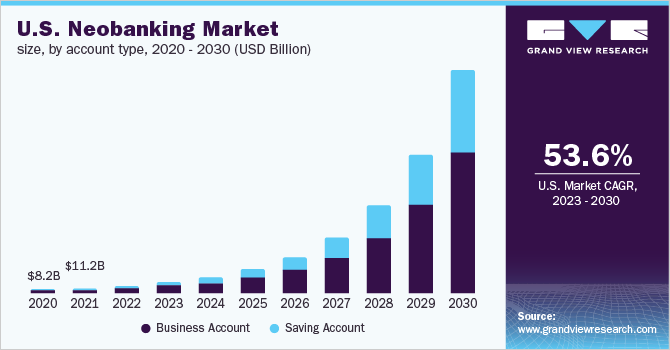

Neobanking Revolution 2024: A Global Financial Paradigm Shift

In the ever-evolving realm of finance, the neobanking phenomenon is poised to continue its meteoric rise in 2024, welcoming a surge of innovative players into the market. Defined as digital-only banks that redefine convenience with 24-hour customer support and low fees, neobanks have become trailblazers in the financial landscape. According to Statista Market Insights, the total transaction value of neobanking is predicted to soar to $722 billion by 2028, boasting an impressive compound annual growth rate of 25.5%.

Figure 3. The Neobanking Market in the USA

Chime, Current, Revolut, Starling, and Varo stand as formidable players in the neobanking realm, reshaping the narrative of financial services by offering user-centric experiences, free instant payments, cost-effective money conversion, and intuitive savings and investment tools. Leveraging machine learning models, neobanks are not just disrupting; they are orchestrating a symphony of innovation, analyzing vast data to swiftly launch new products in weeks instead of years.

Zooming into 2024, neobanking’s scope extends far beyond convenience and accessibility, propelling the industry into uncharted territories of growth and innovation. This disruptive force continues to reshape the traditional banking landscape, catering to a broader range of customers.

From a global perspective, Europe, North America, and emerging markets all stand witness to the unstoppable march of neobanking. In Europe, the UK, Germany, and France lead the charge, embodying the exponential growth of neobanking users, expected to surge from 12.2 million in 2020 to a staggering 63.8 million by 2024. North America braces for significant neobanking growth, with the US projected to double its user base in the next five years. Meanwhile, in emerging markets, neobanks emerge as crucial players in financial inclusion, bridging the gap for the unbanked and underbanked populations.

Forbes foretells a neobanking future, where disruption is not merely a replacement but a creation of an entirely new market. Predicting a revenue surge to over $2 trillion in 2030, neobanks are indeed in an arms race to carve the best platform, propelling transactions into unique contexts. As the neobanking saga unfolds, the market is expected to reach $333.4 billion by 2026, affirming its trajectory of growth with a CAGR of 46.5% from 2021 to 2028.

Neobanking has emerged as a global phenomenon, gaining widespread popularity and boasting key players in Europe, North America, and burgeoning markets. Europe hosts renowned neobanks, including Revolut, N26, Starling Bank, Monzo, and Atom Bank, while North America features prominent names like Chime, Current, Aspiration, and Varo. The impact of neobanks extends to emerging markets, where they play a pivotal role in financial inclusion, catering to the unbanked and underbanked. Notable neobanks in these regions include WeBank in China, KakaoBank in South Korea, and Nubank in Brazil.

Setting themselves apart, neobanks revolutionize financial services by providing user-centric experiences, encompassing free instant payments, cost-effective currency conversion, and intuitive savings and investment tools through user-friendly apps. Their innovative edge extends to the strategic use of machine learning models, enabling them to swiftly analyze extensive data and introduce new products within weeks, a feat that traditional banks often take years to accomplish.

Down FinTech’s troubles the previous year, as we gaze into 2024, the neobanking horizon is expansive, poised to persist as a catalyst for innovation and growth in the banking industry. The disruptive force of neobanks is anticipated to continue reshaping the traditional banking landscape, offering enhanced convenience and accessibility to a broader clientele. Projections indicate that the total transaction value of neobanking will soar to $722 billion by 2028, fueled by an impressive compound annual growth rate of 25.5%. This surge reflects the monumental growth of the neobank industry in response to the escalating demand for digital banking services, with expectations high for sustained expansion in the years to come.

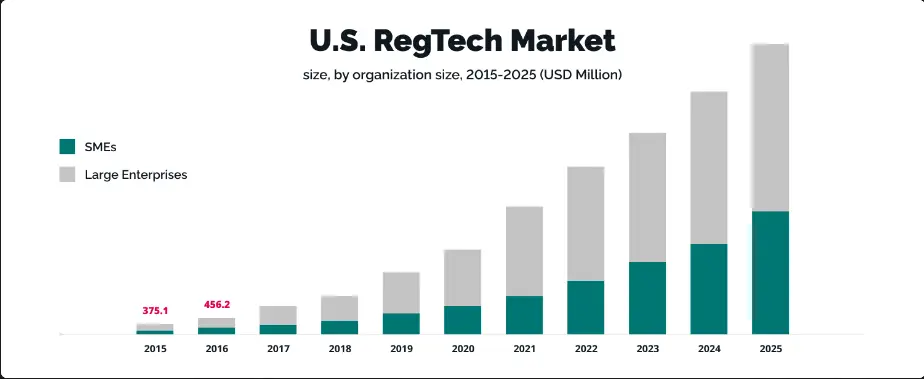

Revolutionizing Compliance: RegTech’s High-Tech Resilience in 2024 and Beyond

RegTech, the superhero of Regulatory Technology, emerges as the beacon for financial institutions navigating the storm of regulatory requirements. This tech-savvy solution isn’t just streamlining compliance processes; it’s rewriting the playbook for efficiency, cost reduction, and automation. According to Investopedia, RegTech is the Avengers team of tech companies tackling challenges spawned by our technology-driven era through ingenious automation.

In a world plagued by data breaches, cyber hacks, and financial fraud, RegTech, armed with big data and machine-learning prowess, becomes the guardian of compliance departments. By exposing money laundering activities conducted in the shadows of online marketplaces, it unveils risks that traditional compliance teams might miss.

Figure 4. The RegTech Market in the USA

The RegTech saga continues in 2024, with a rising league of companies stepping up to offer cutting-edge solutions. PixelPlex’s report unveils RegTech’s role as the commander-in-chief, managing regulatory processes and operations with an arsenal of high-end technologies – big data, the cloud, API, biometrics, robotic process automation, artificial intelligence, machine learning, and blockchain.

The global RegTech market, set to grow at lightning speed with a CAGR of 22.3% from 2021 to 2028, designates North America and Europe as its largest arenas. The Asia-Pacific region, the rising star, is expected to witness the highest growth rate during this tech-powered odyssey. According to a report by MarketsandMarkets, the RegTech market is expected to grow from $6.3 billion in 2020 to $16.0 billion by 2025, at a compound annual growth rate of 20.3% during the forecast period.

RegTech companies are wielding cloud computing and big data as their swords, forming alliances with financial institutions and regulatory bodies. Fenergo, ComplyAdvantage, and Trulioo emerge as the key players in this techno-financial realm. Key players in the realm of RegTech also include various FinTech companies and financial institutions that are at the forefront of adopting and promoting RegTech solutions. These players are creating an impact by offering solutions that help financial institutions comply with regulatory requirements, such as anti-money laundering (AML) and know-your-customer (KYC) regulations. Some of the most popular RegTech companies include ComplyAdvantage, Onfido, and Trulioo.

As we glimpse into the future, RegTech’s growth trajectory in 2024 remains the stuff of legends. Grand View Research foresees the global RegTech market ascending to a monumental $55.28 billion by 2028, surging with a CAGR of 22.3% from 2021 to 2028.

So, let’s buckle up for a thrilling ride into the future of compliance, where RegTech stands as the guardian against financial villains, armed with innovation and cutting-edge technology.

Revolutionizing Transactions: The Epic Rise of Payment Automation Unleashed in 2024!

Payment automation is the use of technology to automate the process of making and receiving payments. It is a function within the accounts payable process, which is a part of the larger procure-to-pay workflow. Payment automation systems can improve supplier relationships, lead to cost savings, reduce fraud risk, and more.

Payment automation is expected to continue its growth trajectory in 2024, with more companies adopting payment automation solutions. A report by globenewswire.com suggests that payment automation can improve the efficiency of the accounts payable process, reduce costs, and improve supplier relationships.

The global payment automation market is expected to grow at a CAGR of 10.6% from 2021 to 2028, with North America and Europe being the largest markets for payment automation solutions. The Asia-Pacific region is expected to witness the highest growth rate during the forecast period.

In terms of key players in the realm, Forbes reports that payment automation companies are in an arms race to develop the best platform to support all types of transactions in unique contexts. Some of the key players in the payment automation industry include MineralTree, Nanonets, and TechFunnel.

As for the scope of payment automation in 2024, it is expected to continue its growth trajectory, with more companies adopting payment automation solutions. Payment automation helps businesses streamline their payment processes, reduce costs, and improve supplier relationships.

Big Data Analytics: A Game-Changer in the FinTech Industry

Big Data Analytics is revolutionizing the FinTech industry by leveraging advanced analytics tools to process large volumes of data and extract valuable insights that can be used to improve financial services. The scope of Big Data Analytics in FinTech is vast, and it has numerous use cases across different areas of finance, including risk management, fraud detection, customer service, and more.

According to a report by McKinsey, the global Big Data Analytics market is expected to grow at a CAGR of 25% between 2021 and 2026. The report also highlights that North America and Europe are the largest markets for Big Data Analytics, with the Asia-Pacific region expected to grow at the highest rate during the forecast period. The report also identifies key players in the Big Data Analytics market, including IBM, Microsoft, Oracle, SAP, and more.

Another report by FinTech Magazine suggests that Big Data Analytics will continue to be a major trend in the FinTech industry in 2024. The report highlights that cybersecurity, crypto, AI, open banking, mobile, and welltech are some of the key areas that could impact the FinTech market going into 2024.

Rain or shine, Big Data Analytics is a rapidly growing trend in the FinTech industry, with numerous use cases and applications across different areas of finance. The market is expected to grow at a significant rate in the coming years, with North America and Europe being the largest markets. The Asia-Pacific region is expected to grow at the highest rate during the forecast period. Key players in the Big Data Analytics market include IBM, Microsoft, Oracle, and SAP. The trend is expected to continue in 2024, with cybersecurity, crypto, AI, open banking, mobile, and welltech being some of the key areas that could impact the FinTech market going into 2024.

Intelligent Automation and AI-Driven Advisory: The Future of FinTech

According to a report by Trinetix, the FinTech industry is undergoing a rapid transformation, with intelligent automation and AI-driven advisory emerging as two of the most prominent trends. The report also highlights that the global FinTech market is expected to reach a value of $556.5 billion by 2030.

Intelligent automation is expected to bring new opportunities for financial services companies to deliver faster, more cost-efficient, and more accurate services. The transformative capabilities of intelligent automation are widely recognized across the financial services sector leaders. As reported by Deloitte, the combination of organizational excellence, intelligent automation, and robotics can yield a total productivity boost of 20-25% within one year.

AI-powered advisory and asset management are also expected to shape the future of the FinTech industry. AI-powered advisory services can help financial service organizations to provide personalized investment advice to their clients. The use of AI in asset management helps financial service organizations optimize their investment portfolios and improve their risk management strategies.

According to a report by MangoPay, AI applications such as creditworthiness assessment, robo-advisory services, algorithmic trading, and risk evaluation and management are expected to become more widespread in 2024. The report also highlights the convergence of financial inclusion and financial wellbeing as a noteworthy trend in 2024. Retail investors, empowered by robo-advisory services, will play a key role in the boom of welltech focused on overall financial wellbeing.

The FinTech industry is expected to proliferate in emerging markets such as Asia-Pacific, Latin America, and Africa. According to a report, the Asia-Pacific region is expected to account for 50% of the global FinTech market by 2025. In North America, the FinTech industry is expected to continue its rapid growth trajectory, propelled by ongoing technological advancements and evolving consumer behaviors.

As a final point, intelligent automation and AI-driven advisory are expected to be two of the most prominent trends in the FinTech sector for 2024. The global FinTech market is expected to grow rapidly, with emerging markets such as Asia-Pacific, Latin America, and Africa accounting for a significant share of the market. The FinTech industry in North America is expected to continue its rapid growth trajectory, propelled by ongoing technological advancements and evolving consumer behaviors.

The Bottom Line: Pulling the Threads Together

In the thrilling world of FinTech, where innovation is king and survival of the fittest reigns supreme, we have witnessed an epic battle royale unfold over the past year. As we approach the dawn of 2024, only the strongest trends have managed to break free from their evolutionary chains and claim their rightful place at the top of the food chain. Just now, we took a look at these top contenders that have emerged victorious after a grueling selection process.

As we move forward into the new frontier of 2024, these three titans stand tall, ready to conquer new horizons and redefine the boundaries of what’s possible in the realm of finance and technology. So buckle up, dear readers, because the ride is far from over!

Time’s a-tickin’, and at MSys Technologies, we’re here to help our clients seize the moment and lead the charge toward a brighter tomorrow. The future of FinTech awaits us all, filled with endless opportunities and exciting discoveries. And who knows, maybe you, too, will become a part of this grand adventure. After all, in the world of FinTech, anything is possible if you dare to dream big and embrace change.