FedNow: A Spotlight on The Federal Reserve’s Instant Payments Service and Its Use Cases

Audio : Listen to This Blog.

Introduction

Are you tired of waiting for days to receive payments? Do you wish there was a faster, more convenient way to transfer funds? Look no further than FedNow, the Federal Reserve’s new instant payments service. With FedNow, individuals and businesses can send and receive instant payments through their depository institution accounts, making everyday payments fast and convenient.

In this blog post, “FedNow: A Spotlight on The Federal Reserve’s Instant Payments Service and Its Use Cases,” we’ll take a closer look at FedNow, its use cases, and how it’s set to revolutionize the payment industry. So, let’s dive in and get your popcorn ready as we embark on a journey to discover the magic of FedNow!

What is FedNow?

FedNow is a new instant payment infrastructure developed by the Federal Reserve that allows financial institutions of every size across the US to provide safe and efficient instant payment services.

FedNow, the long-awaited instant payments service publicized by the Federal Reserve Board back in 2019, officially launched on July 20. This cutting-edge system brings real-time clearing and settlement capabilities, operating 24/7, 365 days a year, and marks a significant step in modernizing the USA financial services industry.

Key Features of FedNow Service: Empowering Real-Time Payments

| Parameter | Details |

|---|---|

| Participants | Permits depository institutions and US branches of foreign banks. Banks can have a service provider to handle payment instructions. |

| Dollar limit | A limit is set to US$25,000. Individual participants can enforce further limits. |

| Operation Hours | Works continuously every day of the year |

| Processing Time | Instantaneous “within seconds.” |

| Transfer Type | Sender-initiated credit transfers |

| Settlement | Banks account balances are debited/credited by FedNow for interbank obligations. |

| Transaction Finality | No cancellation or revoking of processed transactions |

| Message Standard | Adherence to ISO 20022 (the latest international standard) |

| Business Day | Fedwire Funds Service alignment. Not affecting the continuous operation |

| Usage of Master Accounts | Utilize the same as other Federal Reserve services |

| Accounting | Federal Reserve Banks follow FASB principles |

| Liquidity Control | Monitoring intraday liquidity by the Banks is expected to meet Federal Reserve policies. |

| Network Access | Accessible through the FedLine network |

| Pricing | Combination of per-item fees and fixed participation fees. More decisions based on future market practices |

| Request for Payments | Non-value message type that initiates a payment when received |

| Directory Service | Linkages with private-sector directories facilitated by the Federal Reserve |

| Fraud Prevention | Participating banks serve as a frontline of defense |

| Interoperability | Efforts will be made to work with systems like RTP in the future. However, they will not be initially compatible. |

According to Tom Barkin, the president of the Federal Reserve Bank of Richmond and the FedNow Program executive sponsor, the launch of FedNow signifies a groundbreaking achievement in creating a resilient, adaptive, and accessible payments system. Its introduction paves the way for financial institutions to meet customer demands for instant payments, benefiting numerous facets of our economy.

With the service now live, a diverse group of 57 organizations, ranging from banks and payment companies to technology providers, are poised to embrace FedNow, having successfully completed formal testing and certification. This cohort includes 41 financial institutions, 15 service providers, and even the US Department of the Treasury!

Also, the Federal Reserve’s snazzy instant payments service network FedNow already has a squad of 35 cool banks and credit unions, along with 16 top-notch core service providers backing it up! Not too shabby for a fresh launch, especially when some of these big shots are the behemoth banks of the country.

It’s an exciting time in the world of instant payments!

The service is designed to be a flexible, neutral platform that supports various instant payments, enabling more banks to process real-time payments and making payments more accessible, faster, and more convenient for financial institutions, businesses, and individuals.

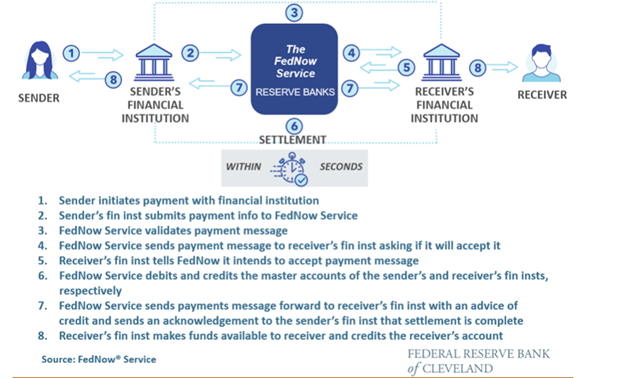

How Does FedNow Work?

Through financial institutions participating in the FedNow Service, businesses and individuals can send and receive instant payments in real-time, around the clock, every day of the year.

The service is designed to maintain uninterrupted 24x7x365 processing with security features to support payment integrity and data security.

Steps in FedNow Service Transaction

What are the Use Cases for FedNow?

FedNow is expected to have a significant impact on the broader payment ecosystem, including small banks and businesses, which will have access to a cost-efficient option for real-time payments.

Additionally, the service is expected to provide compliance and fraud protections, making it more attractive for organizations to adopt. The launch of FedNow is expected to provide a better user experience for customers and make payments easier, faster, and more convenient.

Indeed, FedNow is gearing up for some serious adoption, and it’s got a plan to win hearts and wallets. So, hold on to your hats, folks, and let’s break it down with a few use cases:

- 1. Electrician Extravaganza: Picture this – You hire an electrician to fix some wiring wizardry at your place. Instead of dealing with the hassle of checks or credit cards, the sparky shares their payment details, and you whip out your phone like a digital wizard to pay them right then and there! Presto! Thanks to FedNow, it’s all super easy and cost-effective.

- 2. Catching the Complex: In the future, FedNow has some tricks up its sleeve to tackle the tough stuff. Say goodbye to complicated cross-border payments or person-to-person transactions initiated through aliases like phone numbers or emails. FedNow’s got its sights set on making these puzzlers a breeze!

- 3. Startups, Saddle Up: For the daring startups in the payments arena, it’s a thrilling ride ahead. FedNow means competition, sure, but it also opens doors to incredible innovations. Transactions will settle directly in central bank accounts, offering a level of security that’s top-notch! Get ready for ingenious ideas, slick fraud detection, and wallets that feel like magic.

- 4. Unleashing the Innovation Storm: Brace yourselves for a payment revolution! FedNow’s launch is set to unleash a storm of innovations. Prepare for real-time financial management wizardry with advanced analytics. Keep an eye out for cutting-edge fraud detection systems that’ll give cyber crooks a run for their money. And get ready to explore a whole new world of digital wallets and payment apps that’ll make you feel like you’ve stepped into a sci-fi movie!

With FedNow taking center stage, the payments landscape is in for some electrifying changes. The future is fast, and it’s about to get a whole lot more convenient and exciting!

What Kind of Businesses Will Benefit from Using FedNow for Instant Payments

The flexibility and efficiency of FedNow can transform how businesses send and receive payments, providing a faster and more convenient payment experience for businesses and their customers.

Examples of businesses that could benefit from using FedNow for instant payments include:

- 1. Retailers: Retail businesses can benefit from FedNow by offering their customers the option to make instant payments at the point of sale. This can improve the customer experience by reducing transaction times and providing immediate confirmation of payment.

- 2. E-commerce Platforms: Online businesses can leverage FedNow to provide instant customer payment options. This can help streamline the checkout process and reduce cart abandonment rates, as customers can complete their purchases without delay.

- 3. Gig Economy Workers: Freelancers, independent contractors, and gig economy workers can benefit from instant payments through FedNow. Instead of waiting for days or weeks to receive their earnings, they can receive instant payments for their services, improving their cash flow and financial flexibility.

- 4. Service Providers: Businesses in the service industry, such as plumbers, electricians, and contractors, can use FedNow to receive immediate payment for their services. This eliminates the need to wait for checks to clear or for customers to make manual bank transfers, improving cash flow and reducing administrative tasks.

- 5. Small Businesses: Small businesses can benefit from FedNow by offering instant payment options to their customers. This can help them compete with larger businesses and provide a seamless payment experience, enhancing customer satisfaction and loyalty.

- 6. Peer-to-Peer Payments: FedNow can facilitate instant peer-to-peer payments, allowing individuals to send money to friends, family, or acquaintances in real time. This can be useful for splitting bills, repaying debts, or sending emergency funds quickly and conveniently.

How Is FedNow Different from Other Instant Payment Services In the US?

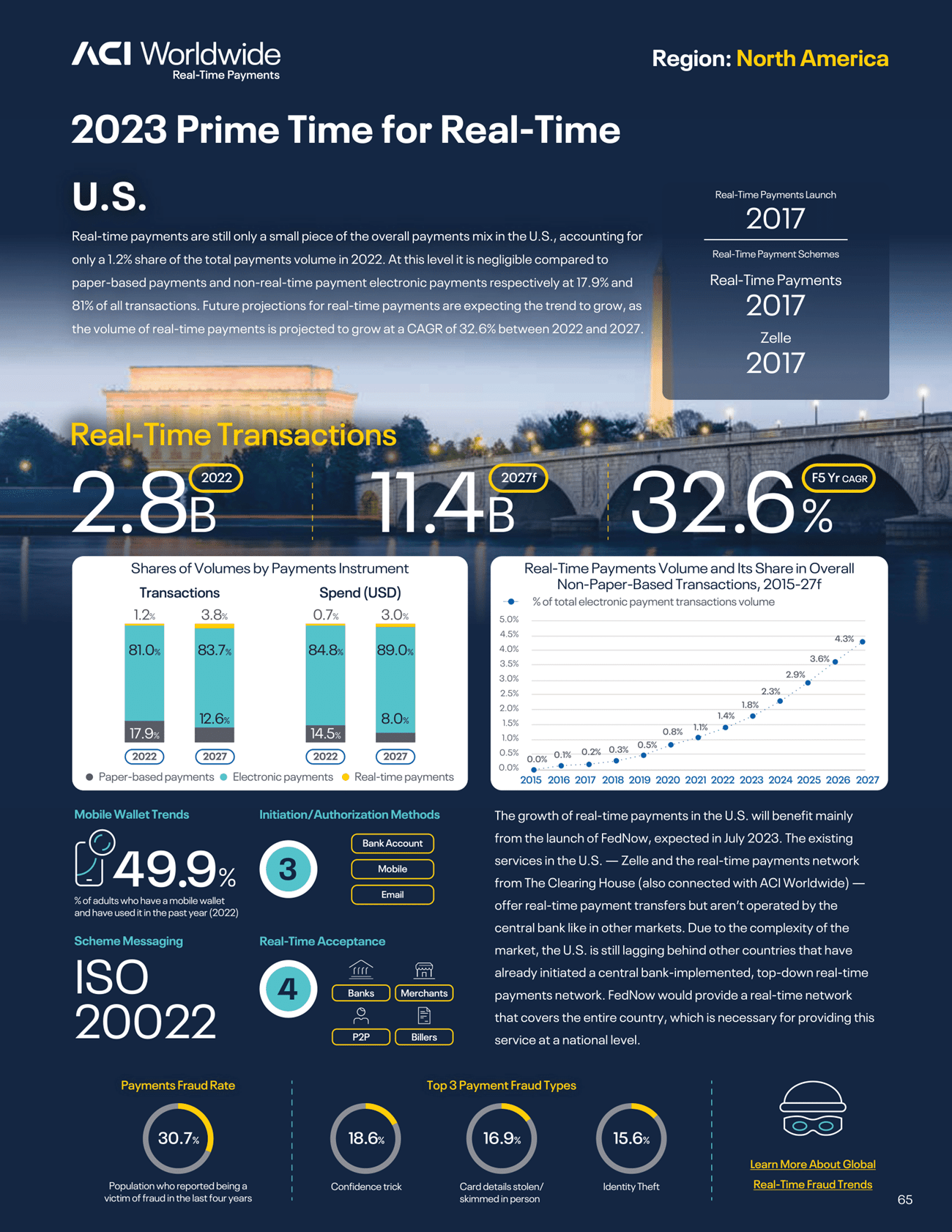

FedNow, the new instant payment infrastructure developed by the Federal Reserve, allows financial institutions of every size across the US to provide safe and efficient instant payment services. FedNow, however, is different from other instant payment services in the US, such as The Clearing House’s (TCH) Real-Time Payments (RTP), as it is accessible to any depositary institution eligible to hold accounts at Federal Reserve banks, whereas RTP is only available to federally insured institutions.

This means FedNow has the potential to create a much larger network effect. However, RTP has a significant head start and is accessible by banks and credit unions, accounting for around 90% of the US’s demand deposit accounts. So, here’s the scoop: FedNow is the inclusive party everyone’s invited to! Any depositary institution eligible to hold accounts at Federal Reserve banks can join in on the fun, unlike RTP, which only welcomes federally insured institutions. This means FedNow’s got the potential to create a massive network ripple that’ll leave everyone in awe!

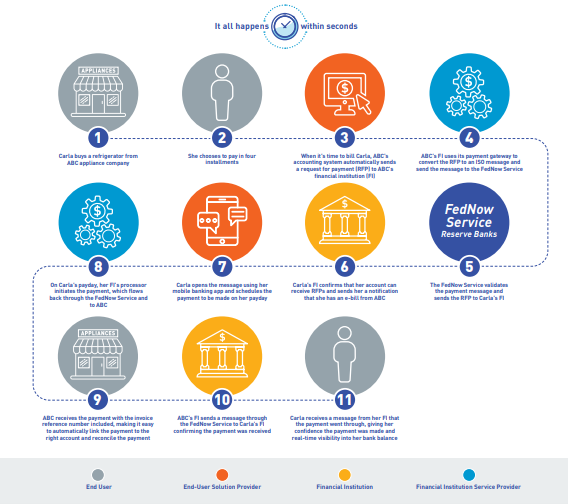

The FedNow Ecosystem In Action

Additionally, the US has other payment services, such as Zelle, Venmo, and CashApp, that are quick enough for the millions of customers using them, even if they do not clear and settle in real-time like FedNow and RTP. These prominent speedy payment services may not be real-time champs like FedNow and RTP, but they sure do the trick for millions of happy customers!

A Glimpse of Real-Time Transactions Ecosphere in the US.

Despite FedNow’s differentiators, such as its wider accessibility, its adoption may be slower than expected, as banks that have already expended resources to connect to these alternatives may be reluctant to join FedNow straight away. So, even with all its cool features, FedNow might have to bide its time before taking the stage. However, with a broad reach and potential to shake things up, FedNow, in the near future, can become the ultimate rockstar in the world of instant payments!

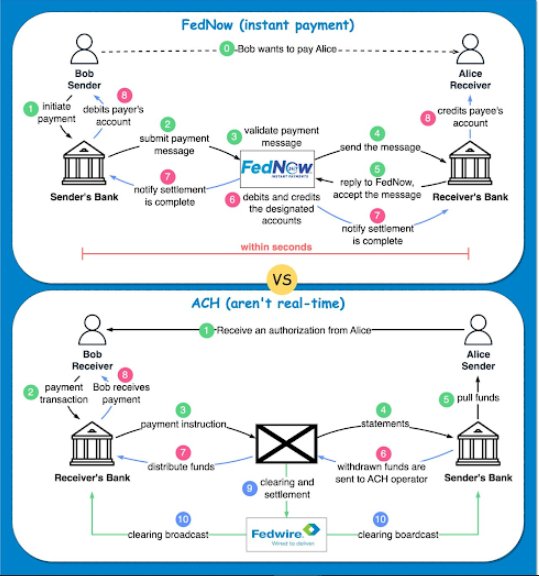

What are the Benefits of Using RTP or FedNow Networks over ACH Batch Clearing Networks?

The real-time payment networks offer numerous advantages over ACH batch clearing networks, including instant funds availability, enhanced customer experience, reduced reconciliation costs, 24/7 availability, faster settlement, cost-effectiveness, and future-proofing.

These benefits make real-time payment networks a compelling choice for businesses looking to streamline their payment processes and provide faster, more convenient payment options to their customers.

Let’s get a deeper glare at some of them:

- 1. Instant Funds Availability: Real-time payment networks like RTP and FedNow provide immediate availability of funds to the receiving person or business. Every payment is final, irrevocable, and confirmed within seconds, ensuring faster access to funds.

- 2. Enhanced Customer Experience: Real-time payments offer a modernized payment experience with near-instant payment confirmations. Initiating payments is simple, ensuring an optimal customer experience. Fast and secure transactions provide more visibility and control over cash flow, improving overall customer satisfaction.

- 3. Reduced Reconciliation Costs: Real-time payment networks provide rich payment and remittance data, which reduces the need for manual reconciliation. This streamlines the payment process and reduces administrative costs associated with reconciling payments.

- 4. 24/7 Availability: Real-time payment networks operate 24/7, including weekends and holidays. This allows businesses and individuals to initiate and receive payments at any time, providing greater flexibility and convenience.

- 5. Faster Settlement: Real-time payment networks offer a near-instant settlement, allowing for faster movement of funds between accounts. This can improve cash flow for businesses and individuals, eliminating the need to wait for funds to clear through traditional batch-clearing processes.

- 6. Cost-Effectiveness: Real-time payment networks like RTP and FedNow have cost-effective transaction fees, typically only a few cents per transaction. This makes them a viable and affordable option for businesses of all sizes.

- 7. Future-Proofing: Real-time payment networks represent the future of payments, enabling businesses to stay ahead in an increasingly digital and fast-paced world. By adopting real-time payment networks, businesses can future-proof their payment capabilities and meet evolving customer expectations.

Roadblocks to the Mass Adoption of FedNow

While FedNow is set to revolutionize the payment industry, several challenges must be addressed for widespread adoption. These challenges include revising regulations, banks’ reluctance to embrace faster payments, costs associated with joining RTP or FedNow, understanding of instant settlement, combating fraud, and slow adoption. Let’s scrutinize each one of these roadblocks to the mass adoption of FedNow:

- 1. Revising Regulation CC: The last remaining step to making FedNow a success is revising Regulation CC to require banks to execute transactions using the fastest means available to them. For many banks, that method may very well be the old tried-and-true ACH batch clearing networks, which is the fastest available if they have not joined RTP or FedNow and have no intention of doing so.

- 2. Banks’ reluctance to embrace faster payments: Banks that have already expended resources to connect to other alternatives such as Zelle, Venmo, and CashApp may be reluctant to join FedNow straight away. This means FedNow’s differentiators may not be as important as it first appears in terms of helping it gain ground at speed.

- 3. Costs associated with joining RTP or FedNow: The cost of joining RTP or FedNow is a legitimate concern, along with the transaction costs, which are generally higher than what banks are accustomed to with ACH networks. However, the expenses linked to joining these systems can be negotiated, and the transaction costs are likely to decrease as membership expands, leading to greater volume.

- 4. Understanding of instant settlement: The key to institutions being prepared to start using FedNow is understanding what instant settlement will mean regarding their liquidity needs and how to handle reconciliation in an ‘always on’ environment. Achieving this will require evaluating back-end processes and, in some cases, system upgrades, and as the FedNow blog points out, neither of these happens quickly at most banks.

- 5. Combating fraud: Getting compliance teams up to speed on managing and preventing the fraud that always comes with a new payment mechanism will be a significant undertaking for banks. The Fed has acknowledged this, as “the initial release of the FedNow Service will include features to help banks manage fraud risk and mitigate fraud losses,” according to Loretta J Mester, president, and CEO of the Federal Reserve Bank of Cleveland.

- 6. Slow adoption: Most of the more than 4000 banks in the US will not be connecting directly to FedNow ; instead, they will be waiting for their core system providers to help them do so. Most of the largest providers, including Jack Henry, FIS, and Fiserv, are in the group, ready to go live at or shortly after FedNow’s launch. However, banks must meet other significant requirements before being prepared to connect.

Imagining FedNow 2.0: Pioneering Horizons in the Woven Tapestry of the US Payment Systems

Cities of the future aren’t the only ones aspiring for an upgrade; Federal Reserve’s trailing blaze under FedNow Service’s banner to dream of a similar tomorrow. A glimpse into the crystal ball envisions FedNow Service blossoming, evolving from a first-of-its-kind instant payment opus into an entity compelling in its stance and more intricate in scope. With the foundation laid, the Fed’s foray into the market maps an onward trail with bolstered principles: enhanced security features, sophisticated APIs, and refined user-access functions. Ultimately, the future for FedNow uncloaks a groundbreaking intersection of financial services, grit, innovation, and technology tinkering that vaults us nearer to the forthcoming era of hyper-immediacy in settlements.

Jumping deeper into the rabbit hole, let’s spotlight some evolution possibilities and real-world uses for the FedNow Service:

-

1. Enhanced Fraud Protection: Whereas today’s FedNow Service comes hand-in-hand with basic transactional limit settings, the future may outdo the present by integrating advanced AI patterns in magnifying fraudulent activities before a dime even changes hands, just as our car sensors throw caution signals when another vehicle is too close.

Use Case Example: E-commerce giants can drastically decrease financial anomalies in new customer transactions. -

2. Sophisticated APIs and Accompanying Interfaces: The forthcoming years of FedNow could see the construction of nimble APIs for tech-savvy developers that allow smoother adaptation in the real-world payments labyrinth plus the enthralling shifts in third-party-developed banking platforms.

Use Case Example: A Web Developer Retail Collective might cleverly exploit these APIs to develop custom instant payment facilitation for smaller neighborhood shops still fresh on the eCommerce waves. -

3. Bulk Payments: Post setting its basic footprints, it foresees itself integrating an avenue for establishing bulk payments easing corporate mouths, and democratizing invoice payments.

Use Case Example: Novel, budding recruitment startups can eliminate the gigantic wave of wage dispersion by adroitly managing optimal salary transfers weekly, monthly, or contractual. -

4. Remittance Info Enhancement: Financial transparency poised with behemoth potential to empower transactions where parties can tailor-make messages that both sender and receiver will appreciate – declaring what, why, and how behind every transaction.

Use Case Example: Non-profit Organizations with multiple donors from around the country can receive purpose-tagged instant funds and know the donor intention behind each donated dollar, enabling smarter funds to deploy.

These speculated advancements press the playbook onto hammering out ceaseless innovation while speed remains auxiliary. This further reiterates FedNow’s vision of facilitating payment services driven by robust security and frictionless usability.

Will FedNow Disrupt or Replace Cryptocurrencies?

FedNow is a new instant payment infrastructure developed by the Federal Reserve that allows financial institutions of every size across the US to provide safe and efficient instant payment services. While FedNow is not a cryptocurrency, it is expected to revolutionize money movement by enabling more banks to process real-time payments. The service is designed to be a flexible, neutral platform that supports a wide variety of instant payments, enabling businesses and individuals to send and receive instant payments in real time, around the clock, every day of the year. While some have speculated that FedNow could make cryptocurrencies obsolete, others argue that the two can coexist, with cryptocurrencies offering unique benefits such as decentralization and anonymity. Overall, FedNow is set to provide a cost-efficient option for real-time payments, making payments more accessible, faster, and more convenient for financial institutions, businesses, and individuals.

Bringing the Curtain Down

FedNow is a groundbreaking instant payment system developed by the Federal Reserve that is set to revolutionize the payment industry. With its real-time payment capabilities, FedNow will enable individuals and businesses to send and receive instant payments through their depository institution accounts, making everyday payments fast and convenient.

Although, the FedNow Service is expected to provide a cost-efficient option, making it more attractive for small banks and businesses to adopt. However, the reality is that consumers won’t get much from the new payment rail that they don’t already get, at least in the near term. With many of the largest banks already on the TCH platform, real-time payments volume on that network will dwarf FedNow’s volume for many years. Slower adoption on the send side of the equation and increasing fraud will slow the rollout of new instant payment use cases. The impact of FedNow will depend on banks’ commitment to payments as a strategic differentiator, use case evolution, tech vendor support, and fraud prevention and management. As more banks choose to use this new tool, the benefits to individuals and businesses will include enabling a person to immediately access funds, enhancing customer experience, reducing reconciliation costs, and providing 24/7 availability. The FedNow Service is a foundation for the broader payment ecosystem to develop a wide range of modern, innovative, and safe instant payment capabilities.

And that’s a wrap on our journey through the incredible world of FedNow and its use cases!

FedNow is the superhero we’ve been waiting for, swooping in to save the day with its groundbreaking instant payment system developed by the Federal Reserve. Say goodbye to waiting for days to receive payments! With FedNow, it’s all about lightning-fast transfers and convenience for individuals and businesses.

However, let’s face it; even the Crusaders have their challenges! FedNow’s got the potential to shake things up, but it’s facing some competition from the likes of RTP and other quick payment services like Zelle, Venmo, and CashApp.

As we dive into the future, it’s clear that FedNow’s impact will depend on banks’ commitment to embrace this new player, evolve those use cases, and stay on top of fraud prevention and management. It’s all about staying agile and resilient!

MSys Technologies, the ultimate sidekick, is ready to deliver real-time excellence for our customers! With our cutting-edge FinTech solutions and a team of 250+ skilled engineers, we’re here to help you ride the real-time payments wave like a pro. We’re the cape-flaunting, quick-thinking, high-flying answer to your FinTech SOS distress signal!

We’ve covered you, from innovative fraud detection systems to advanced analytics for real-time financial management. Let’s co-create an integrated payments ecosystem, taking your financial services business to new heights with speed, accuracy, and total customer satisfaction!

Let us punch a hole through the clouds, grab the moon of the integrated payments universe and throw it right into your ambitious lap! Watch as your financial services business soars from sea-level blah to stratospheric POW, with more praise than the reception of the last Super Bowl Half Time show.

We have a clear vision to co-create a Fintech mission that’s both clear and conceivable. Switch up your sneakers for boost-powered rocket boots – it’s time you pogo-rocketed your fintech domain to superhero status. Let’s jazz up your business story together at warp speed!