Artificial Intelligence Taking over Wall Street trading

Audio : Listen to This Blog.

One of the biggest reason trading decisions are affected is because of human emotions. Machines and algorithms can make complicated decisions and execute trades at a rate which no human can match and is not influenced by emotions. The parameters these algorithms take into consideration are price variations, macroeconomic data volume changes similar to accounting information of different corporate companies and news articles from various times to

predict the nature of a particular stock.

Stock prediction can be done using the company's historical data. This historical data can be used to perform either Linear regression or Support Vector Regression depending on the complexity of the system, to discover trends in the stock market. The algorithm can access various real time news papers and journals to retrieve the latest news and information regarding a specific company. This data is then processed and analysed along with the historical data and data derived from the quarterly results and press releases of that company. This helps in predicting a stock price of a specific company.

If we need to analyze the whole market, consisting of more than 6000 companies listed in the New York Stock Exchange, we can do that too in the similar manner by navigating through the regulatory filings, social media posts, real time news feed and other finance related metrics also involving elements such as correlations and valuations in order to predict investments which are considered undervalued.

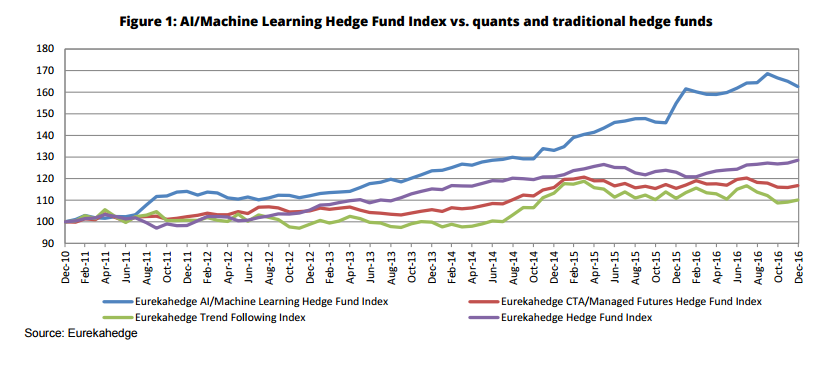

AI is already in use by institutional traders and are incorporated in tools used for stock trading. Some of which are completely automated and are used by Hedge Funds. Most of these systems can detect minute changes caused by a number of factors and historical data. As a result thousands of trades are performed on single day.

An interesting example:

It was noticed that, everytime Anne Hathaway was mentioned in the news, the share price of Berkshire Hathaway increased. This was probably because, there was some algorithm from a trading firm running automatic trades whenever it came across “Hathaway” in the news.

This particular example is a false positive and the fact that this system can run automatic trades based on real time news feed is pretty interesting. This technique requires data ingestion, sentiment analysis and entity detection.

If the system or algorithm can detect and react to positive news feed faster than anybody else in the market, then one can make the profit that is the leap(or decrease) in price.

Citation: http://www.eurekahedge.com/Research/News/1614/Artificial-Intelligence- AI-Hedge-Fund-Index- Strategy-Profile